Feature Story Chinese buyers fueling 30% boom in vintage VLCC values

페이지 정보

작성자 최고관리자 댓글 0건 조회 25회 작성일 25-09-11 11:34본문

Chinese buyers fueling 30% boom in vintage VLCC values

- Increased S&P activity in Asia's largest economy is reshaping the VLCC market, turning ageing tankers into premium assets.

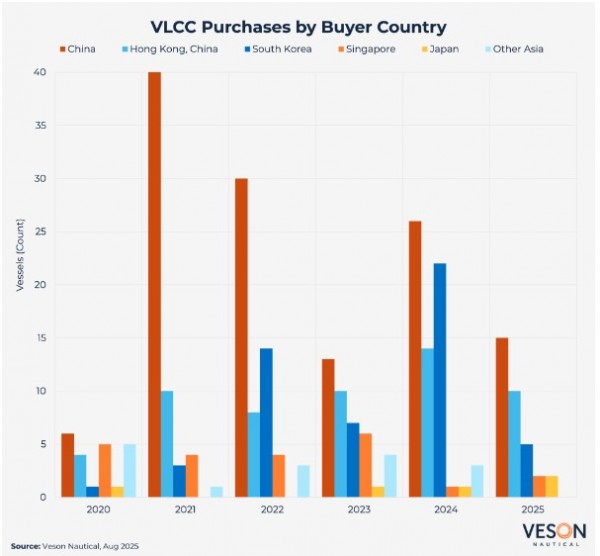

Chinese buyers are fueling a sharp rise in demand for vintage very large crude carriers (VLCCs), with 81% of their acquisitions in this class involving vessels more than 15 years old over the last five years. This trend reflects structural changes in global oil flows since Russia’s invasion of Ukraine, where sanctions and the emergence of a shadow “dark fleet” have created premiums for older vessels that compliant modern tonnage cannot access, according to the latest Market Insight from Veson Nautical, a global leader in maritime data and freight management solutions.

The report, titled ‘The Changing Face of Asian S&P Behaviour’ states that values for 25-year-old VLCCs have surged 31.6% year-to-date, compared with just 0.5% growth for five-year-old units. This inversion highlights how sanctions, shifting trade flows, and demand for sanctioned crude are driving premiums for older tonnage, even as newer vessels trade at relatively stable levels.

“Vintage VLCCs are now trading at levels that would have been unthinkable just a few years ago,” said Matt Freeman, Senior Vice President of Values and Analytics at Veson Nautical. “The July sale of the Eon (ex. Atlantic Loyalty) for USD 44 million is nearly double the fixed aged term median. This underlines how demand linked to sanctioned trades is reshaping asset values and overturning conventional market logic.”

The report also adds that China’s appetite for older VLCCs reflects a combination of structural and geopolitical forces. Western sanctions on Russian crude have fractured the market into parallel systems, with a so-called “dark fleet” of older tankers now operating outside mainstream compliance regimes. These vessels, averaging 18.1 years in age versus 10.4 years for the legitimate fleet, have found new purpose in sanctioned trades where availability outweighs reputation and insurance. In this parallel system, older VLCCs can command meaningful premiums over younger compliant units, as the pool of vessels able to assume regulatory risk remains limited.

The report also states that what might appear irrational in conventional shipping cycles is, in fact, a calculated strategy within a reshaped market. Sanctions, capital advantages, and shifting trade flows have combined to tilt the economics in favor of vintage vessels, particularly for Chinese buyers.

“China’s buying strategy makes sense once you understand the forces reshaping tanker markets,” said Matt Freeman, Senior Vice President of Values and Analytics at Veson Nautical. “Sanctions have created a parallel trading system where older VLCCs can command earnings that exceed younger vessels, and financing advantages allow Chinese owners to move quickly and capitalize on these types of opportunities. Added to this, the surge in Russian crude flowing into Asia has created a steady stream of demand that makes these vintage assets more valuable than ever.”

The report also highlights how strategies vary widely across Asia. While Chinese buyers dominate overall volumes and concentrate heavily on vintage VLCCs, South Korean owners have focused on countercyclical acquisitions of mid-life vessels, and Japanese buyers have largely avoided older VLCCs in favor of younger MR2s which are widely considered more versatile assets. These contrasting approaches reflect differing financing structures, regulatory constraints, and long-term strategic priorities.

“These trends underscore how Asian ownership is reshaping the rules of shipping investment,” said Felix Tordoff, Junior Valuation Analyst at Veson Nautical. “China has concentrated on vintage VLCCs, often targeting sanction-exposed trades where premiums are unavailable to modern tonnage, while South Korean owners have taken a more countercyclical but quality-driven approach to mid-life vessels. Japanese buyers, by contrast, have largely avoided older VLCCs, focusing instead on younger MR2s that align with stricter financing and regulatory requirements. Together, these strategies demonstrate how structural forces are redefining the market far beyond short-term cycles.”

■ Contact: Veson Nautical www.veson.com