Special Report The Current Condition Of The Shipbuilding And Marine Information And C…

페이지 정보

작성자 최고관리자 댓글 0건 조회 4,422회 작성일 20-02-17 17:14본문

I. The current condition of Korea’s shipbuilding and marine ICT industry

1. Shipbuilding and marine and related ICT industry summary

The shipbuilding and marine industry refers to a knowledge-based engineering industry inclusive of various classes of ships, marine infrastructure, and related equipment as well as their design, manufacturing, and installation. This industry needs a range of labour from designers to technicians. Today, ICT integration ever-increases vessel quality improvement, cost reduction, vessel innovation, automated navigation, and shipyard optimisation.

The shipbuilding and marine(plant) industry’s share numerous similarities; however, differences do emerge between purpose, its clients, and core competencies.

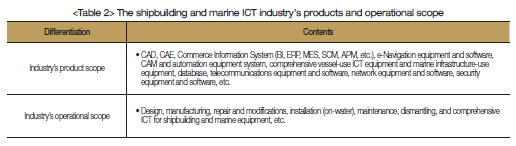

The shipbuilding and marine ICT industry refers to the various ICT technologies integrated into the shipbuilding and marine industry. This industry also highlights Korea’s attempts at reinforcing its competitiveness through job creation and high value-added development as part of the Fourth Industrial Revolution’s convergence towards the development of the industry’s structure.

2. Shipbuilding and marine industry’s current condition

The shipbuilding and marine industry’s main products are ships and marine infrastructure. Most production is carried-out following orders; as a result, the industry structure intensely caters to its demand. The shipbuilding and marine ‘ecosystem’ consists of several large corporations with the rest being made-up of small-to-medium enterprises(SMEs). The SMEs cooperate with large corporations to establish and maintain a working structure.

The shipbuilding and marine industry share important relations not only with up-stream sectors such as shipping, fisheries, and leisure vessels, but also with down-stream sectors such as steel, ICT, machinery, electricity, and chemicals. The shipbuilding and marine industry accounts for 7% of Korea’s exports and employment, 4% of production amongst manufacturing industries, and is a significant contributor to the regional economies of Gyeongnam Province, Ulsan CIty, Busan City, Jeongnam Province, and Jeongbuk Province.

Korea’s shipbuilders are highly regarded amongst global builders with the industry accounting for over 50% of the global high value-added ship market.

The shipbuilding and marine industry have diverged from their focus on product functionality improvement to responsiveness regarding environmentally-friendly legislation and comprehensive innovation assisted by ICT technologies.

• Vessel and navigational ‘Smartization’: Currently undergoing vessel ‘Smartization’ through the application of the Fourth Industrial Revolution technologies such as Internet of Things(IoT) and big data

• Machinery ‘Smartization’: Remote diagnosis and maintenance, efficient navigation, enhanced machinery-related efficiency, and development of total remote solutions

• Production ‘Smartization’(Smart Shipyards): ICTinfrastructure-based production process and distribution innovation through real-time data-based production maintenance monitoring and safe working environment creation

3. The shipbuilding and marine industry’s difficulties and structural issues

The global shipbuilding industry showed strong signs of growth until the mid-2000s. Following continued economic hardship following the Global Financial Crisis(GFC) in 2008, the industry hit new lows in 2016.

The global ship order rate fell 67% in 2016. It, however, did bounce back in 2017, but consistently sat at around 2011 – 2015’s average of 58%. Korea’s contract obtention rate also fell by 80.2% in 2016.

Average ship value dropped 33% from 2008 levels but began to show signs of stability in 2017. Despite so, recovery was delayed due to distribution overcapacity. A rebound was anticipated from marine pollution prevention regulations, vessel decommissioning, and higher oil prices; however, without improvements to the general global economy, it will be difficult for the shipbuilding industry to revive itself.

Also, as Korea’s shipbuilding corporations turned their focus towards marine plant order obtention, China’s general-use vessel market share increased from orders for ultra-large container ships. Singapore and Vietnam are looking for low cost-use marine plants and multi-use vessels. As a result, Korea’s shipbuilding and marine market’s business record has worsened and undergone serious restructuring(2007: 30 firms → currently: five firms) and reduced employment(2015: 188,000 → 2017: 114,000).

Korea’s shipbuilding and marine industry’s large corporations have successfully secured experience; however, SME shipbuilders and machinery manufacturers lack experience. Large corporations (including Samho Mipo) account for 90% of all revenue and 88% of employment. Medium-sized firms, through restructuring and cost-cutting, lack in research and development(R&D) efforts, leading to loss of competitiveness in order obtention, exacerbating their lack of experience. Instead, high value and core machineries such as navigation, communications, and electrical equipment are imported from Japan and Europe.

Korea’s ‘Big 3’ shipbuilders targeted the marine plant market to mitigate losses in vessel order obtention. Also, as Korea’s SME shipbuilders go bankrupt and Hanjin Shipping faces trouble, Korea’s shipbuilding and marine industry are gradually fracturing. To re-establish Korea’s shipbuilding industry’s competitiveness, emphasis must be placed on entering new markets through high value-added products and services, domestication of marine machinery production, and overall increased competitiveness.

II. Shipbuilding and marine ICT industry-related regulations by major players in preparation for the Fourth Industrial Revolution

1. Japan

NYK (one of Japan’s ‘Big 3’ shipping companies) announced a joint autonomous vessel development project with shipbuilders and Japan’s Ministry of Land, Infrastructure and Transport in June 2017 in response to the Fourth Industrial Revolution. The project aims to install Artificial Intelligence (AI)-assisted autonomous systems to calculate efficient shipping routes to 250 vessels by 2025.

Details of the autonomous vessel development project were released by the Ministry of Land, Infrastructure and Transport in June 2017 as a part of Prime Minister Abe’s “Japan Revitalization Strategy” in cooperation with Mitsubishi Heavy Industry and other shipbuilders.

MOL (the world’s largest LNG shipping company) and Mitsui Shipbuilding, through the use of data cumulation devices, announced in June 2017 that it would develop a new generation of vessel management systems with the use of AI technologies. The project aims to install Mitsui’s data cumulation devices onto MOL’s vessels, accumulate data from various routes, and use AI to analyse and calculate optimal navigation routes. Also, developments with the use of IoT such as autonomous cranes, crewmember education and support services, other comprehensive preparations for LNG carriers, and other technological advances in preparation for international regulations for Fourth Industrial Revolution are being sought.

2. China

Online logistics services platform YunQuNa, an example of shipping and the internet’s synergy, is being actively introduced. Global logistics companies Maersk and CMA-CGM have partnered with YunQuNa to establish a ‘one-stop’ international logistics service. China’s Ministry of Transport released information highlighting the existence of over 200 online sea logistics-related platforms such as distribution maintenance software and logistics data platforms.

Shanghai’s deep-water port has four automated container terminals allowing for unmanned loading and unloading. These terminals are China’s first-ever implementation of automatic machinery and control system.

China’s legislation finance institution, the Export-Import Bank of China, expanded financial support to the shipbuilding and marine industries. In 2017, over 730 Billion RMB(120.9 Trillion KRW) in funding was provided. Other projects in response to the Fourth Industrial Revolution, such as high-skilled labour and the development of LNG tanker are also being undertaken.

3. The EU and the US

Maersk, in partnership with IBM, created a comprehensive logistics platform with the use of blockchain technology(July 2017). This platform connects the data of all containers across the globe using IoT and blockchain technologies.

Norway, in collaboration with a ship electrical engineering company, is in the process of constructing an autonomous electric vessel with an estimated completion date of 2020. The purpose of this ship is to minimise the emission of environmental pollutants.

Rolls-Royce has begun testing its remote-controlled vessel in Denmark(July 2017). Post-testing, all onboard crew will be relocated to on-land facilities, which will also help to minimise accidents. Other large-scale LNG liquefaction plants are also being looked into.

4. Korea

Korea’s large corporations are focusing their efforts on acquiring container shipping and general on-water logistics technology integrated with bigdata and blockchain technology.

In August 2017, Hyundai Merchant Shipping began testing blockchain-integrated shipping technology on its container ships. The entire distribution process was managed through the use of blockchain technology. Samsung SDS established a shipping blockchain consortium with port authorities, shipping companies, customs, and finance companies in May 2017, and is in the process of expanding their business and applicability of their technology.

Korea’s shipbuilders are, from many angles, looking for ways of integrating ICT technology into the shipbuilding and marine industry through such as the use of new technologies to complete difficult tasks and the ‘Smartization’ of shipyards. To advance analogue-based measurement systems and welding infrastructure, ICT and digital sensor-based data collection, diagnosis, monitoring, and integrated management systems are being developed. Also, to create a paper-free working environment, a digitised drawing and 3D modelling system utilising big data technology has been developed. The entire shipbuilding process is reproduced digitally to help the development and efficient implementation of operating systems with big data, IoT, augmented reality (AR) and overall intelligent facilities.

Upon examining Korea’s of shipbuilding and marine industry, application of technology from the Fourth Industrial Revolution into the shipbuilding and marine industry is laggard. Reinforced and expedited technological development by SMEs is especially required. Other technologies such as autonomous ships and remote control are in the process of being developed; however, compared to other nations, Korea is still in the ‘lab-testing’ phase.

The ICT synergy ‘Industry4.0S (shipbuilding and marine) Project’ is partially funding technological development, but as a depressed economy threatens various SMEs, the government ought to step-in with active policy and programmes to revive both SMEs and large corporations.

National Information Technology(IT) Industry Promotion Agency(NIPA), Software Industry Division, Regional Software Industry Team, Jae-hun Jung

※ Will continue next month.