Feature Story Regional Analysis And Implications Of Major Industries In China(Shipbu…

페이지 정보

작성자 최고관리자 댓글 0건 조회 5,251회 작성일 19-11-15 16:23본문

2. The Shipbuilding Industry’s Production Characteristics By Region

(1) Distribution of Production Area and Market Share by Region

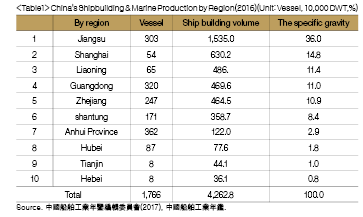

In 2016, China had around 601 steel shipbuilders. There were also approximately 542 equipment suppliers, 199 ship renovation and repairers, and 68 offshore engineering and construction companies. Upon examining China’s shipbuilding and marine production figures for 2016, Jiangsu Province’s builders constructed 303 vessels, equivalent to 15.35 million Deadweight Tonnage (DWT), accounting for 36% of China’s total share. Second was Hainan Province and Shanghai, China State Shipbuilding Corporation(CSSC)’s strongholds, which constructed 54 vessels, equivalent to 6.2 million DWT. Third was Liaoning Province, China State Industry Corporation(CSIC)’s stronghold, which built 65 ships, equal to 4.9 million DWT. Fourth was CSSC’s jurisdiction in parts of the Pearl River Basin and Guangdong Province, which constructed 320 vessels, equivalent to 4.9 million DWT. Lastly was Zhejiang Province, which built 247 ships, equal to 4.6 million DWT.

Upon examining China’s periodic regional production figures and market share, Jiangsu, which is home to the world’s fourth and ninth-largest shipyards, had China’s highest market share accounting for 25 – 36%. Shanghai was second through CSSC’s strong position, which helped to establish an overall market share of 15 – 24%, while Liaoning, CSIC’s stronghold, was third and fourth, accounting for 11 – 18%. Meanwhile, in the upper regions of the Yangtze River, Anhui Province was fifteenth, accounting for only 0.3% of the market share in 2007. However, by 2016, following the beginning of Chizhou City’s shipbuilding initiative, Anhui was able to rise to seventh with a market share of 2.9%. It was the same for Hebei Province which rose from thirteenth in 2007 with a market share of 0.4% to tenth by 2016 with a market share of 0.8%.

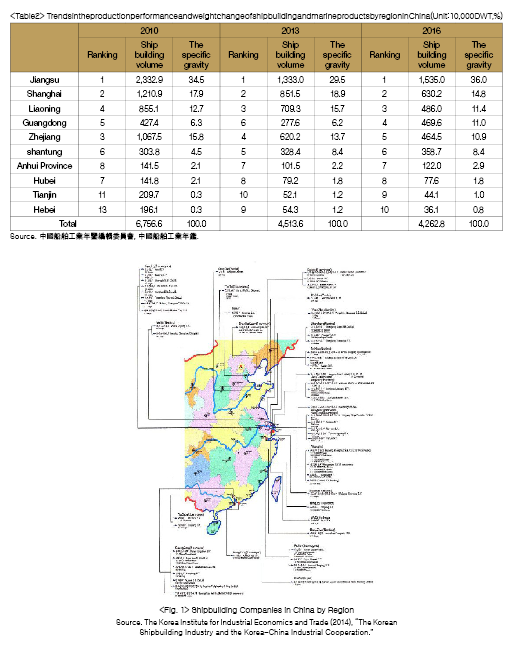

Concerning shipbuilding, proximity to the coast is essential. As a result, China’s shipbuilding industry has developed along the coast, especially in regions where rivers flow into the sea, such as the Yangtze River Basin, the Pearl River Basin, and Dalian.

(2) Distribution of Major Shipbuilders by Region and Their Characteristics

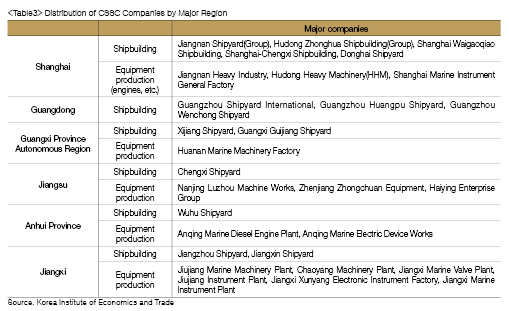

State-owned shipbuilders make up a large portion of China’s shipbuilding and marine industry. These companies for based around the Yangtze River with CSIC to the north and CSSC to the south. CSSC, CSIC, and its subsidiaries, such as shipbuilders, equipment manufacturers, and research institutes, were first established to induce competition with one another. As a result, the two state-owned enterprises(SOEs) were similar in most aspects; however, now, CSSC’s shipbuilding market share is higher than CSIC’s. CSSC’s shipbuilding facilities are in Shanghai and Guangdong with equipment manufacturing facilities located throughout Guangxi Zhuang Autonomous Region, Jiangsu, Anhui, and Jiangxi Provinces.

On the other hand, CSIC’s subsidiaries, which are predominantly equipment companies, are located throughout China’s northern regions, such as Liaoning, Tianjin, Shandong, Hebei, and Jiangsu Provinces. CSIC’s subsidiaries consist of seven shipyards, 54 engine, and engine parts manufacturers, and equipment companies.

Liaoning’s major shipbuilders are Dalian Shipbuilding Industry Company(new vessels and marine business), Bohai Shipyard, Dalian COSCO-KHI Ship Engineering(DACKS), Dalian COSCO Shipbuilding Industry(new vessels, repairs, and marine business), and Dalian Marine Diesel Company. Tianjin’s major shipbuilding and marine companies consist of five shipbuilders, three equipment suppliers, seven ship renovation and repairers, and four offshore plant-related companies. Also, many of the region’s major shipyards and marine plant manufacturers, repairers, and equipment manufacturers are in the Bohai Bay Marine Cluster, such as Tianjin New Port Shipping Heavy Industry, Tianjin Xinhe Shipbuilding Heavy Industry, MSC Tianjin, and TIDFORE.

In Shandong, where Daewoo Shipbuilding & Marine Engineering and Samsung Heavy Industries have block production plants, are also several state-owned shipyards such as Qingdao North Sea Heavy Industry Company(new vessels and repairs), Yellow Sea Shipbuilding, and Weihai Docks which work closely with other regional shipyards and marine oil processors. Meanwhile, since 2013, the regional distribution of ‘White List Companies’, which have been restructured by the Chinese government following the continued market downturn, are predominantly based in Jiangsu, Shanghai, and Liaoning.

3. The Shipbuilding Industry’s Market Size and Characteristics by Region

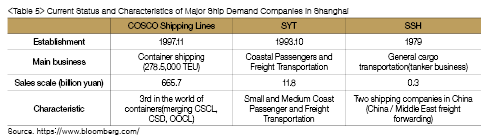

In 2017, China’s possessed 5,206 vessels, with a total of 165.7 million DWT and a capacity of over 1000 Gross Tonnage(GT). Total possession was just behind that of Greece and Japan, with demand fuelled by state-owned shipping companies.

Regional distribution is not important as operating areas are by sea or river. In particular, large vessels such as container ships, which mainly use fixed shipping routes, are used for international freight transportation, and bulk carriers mostly carry grain, coal, and iron-ore between mountainous areas and large ports within the mainland. Also, small- and medium-sized river vessels are demanded in areas near rivers in which they are used as fishing boats, small- and mid-sized cargo ships, cruise ships, or ferries.

The highest demand for Chinese-built ships was from Hong Kong, where major shipping companies are concentrated. As of the end of 2016, a total of 64 vessels were ordered, equivalent to 1.8 million CGT, representing an estimated 33% of China’s aggregate domestic demand (or 27.5% of 2017’s trade value). Excluding light-weight durable consumer vessels, such as leisure boats, most of China’s demand was for producer vessels, mainly from shipping companies based in Shanghai, Tianjin, Nanjing, and Guangzhou.

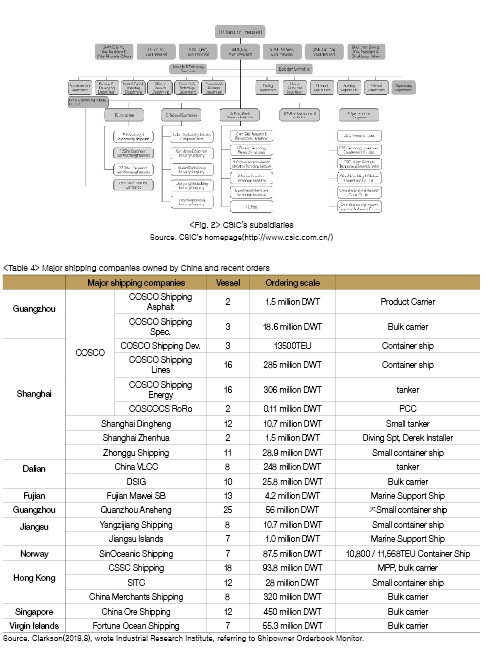

Shanghai is now home to China’s biggest state-owned shipping company, China COSCO Holdings, following the companies acquisition of China Shipping Container Lines(CSCL), China’s second-largest shipping company, and China Shipping Development, as well as several private other companies such as Shanghai Ya Tong and Sino Shipping Holdings.

After COSCO acquired CSCL and Hong Kong’s, OOCL, its Twenty-foot Equivalent Unit(TEU) rose to 2.8 million. Consequentially, it overtook CMA CGM to become the world’s third-largest shipping company. COSCO is now responsible for most of China’s coastal and ocean-to-inland cargo transportation.

In other major regions, demand for ships was also centred around major shipping companies and their proximity to coastal cities, for example: COSCO’s basis in Beijing; Nanjing Tanker in Nanjing; Ningbo Marine in Ningbo; Winland Online Shipping Holdings in Dalian; and Winland Ocean Shipping and Hainan Harbor and Shipping Holdings in Hainan. COSCO has more than 600 merchant ships, equivalent to 35 million DWT, and transports over 300 million tons of cargo annually. COSCO’s main operational bases are in Guangzhou, Shanghai, Tianjin, Qingdao, Dalian, Xiamen, and Hong Kong. The company’s fleet consists of container ships, specialized transportation vessels such as oil tankers, various ocean-going ships, and terminal operation vessels, with operations to over 160 countries and 1,300 ports and harbours, globally.

Nanjing Tanker was established in September 1993 for oil and chemical storage and transportation. Ningbo Marine was established in April 1997 for inshore shipping, such as freight transportation on coastal rivers and inland rivers such as the Yangtze River and international transportation operations.

4. China’s Shipbuilding Industry’s Trade Trends by Region

(1) The Shipbuilding Industry’s Import and Export Trends by Region

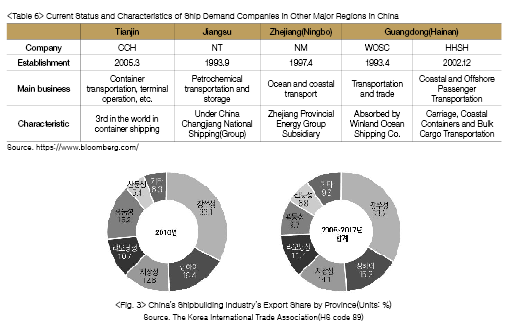

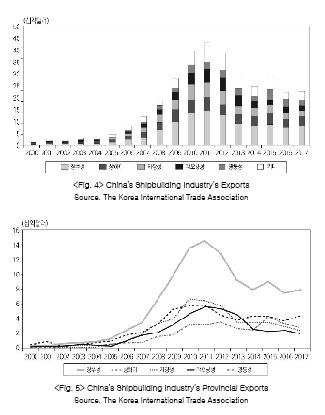

Over the past ten years, China’s shipbuilding industry’s export market has developed actively in regions such as(listed from the largest regional market in descending order) Jiangsu, Shanghai, Zhejiang, Liaoning, Guangdong, and Shandong. In 2016, the order changed to Jiangsu, Shanghai, Guangdong, Zhejiang, Liaoning, and Shandong. It was established that areas with high production also accounted for top exports. In 2016, Shanghai, Guangdong, and Zhejiang had higher exports relative to production, while Jiangsu, Liaoning, and Shandong’s production were relatively lower. This was due to the location of globally recognized companies such as Hudong-Zhonghua Shipyard and Shanghai Waigaoqiao Shipbuilding, and CSSC, which were based in Shanghai and Guangdong, respectively. In 2016, the five biggest provincial export markets accounted for 88.3% of all exports, which was a rise from their ten-year average of 83.9%. However, as the shipbuilding industry undergoes restructuring, the number of shipyards are falling and being concentrated around major shipbuilding regions.

In 2011, China’s shipbuilding industry’s exports were worth $43.7 billion, but due to the industry-wide recession, export declined to $22.5 billion and $22.9 billion in 2016 and 2017, respectively.

By region, Jiangsu saw exports peak in 2011 with exports totaling $14.7 billion but also experienced declines in 2016 and 2017 with exports worth $7.5 billion and $8 billion, respectively. During the industry boom, Jiangsu exports grew the fastest, followed by Shanghai and Zhejiang. In Liaoning, exports surged between 2009 and 2012 when STX Dalian was in full operation. However, following the company’s bankruptcy, the province’s exports contracted significantly.

Despite so, most imports were coming out from Guangdong, Jiangsu, Shandong, Tianjin, and Shanghai, where all the major shipping companies are.

Ship imports varied depending on the shipping company’s strategy at the time. However, when compared to exports, the regional variance was high and has remained so ever since the Global Financial Crisis. Since the shipbuilding industry’s recession in 2009, the Chinese government has actively supported the shipbuilding and shipping industry’s. In turn, this helped to strengthen the competitiveness of shipping companies. In 2009, after major shipbuilders and shipping companies experienced a contracting market, ship prices plunged. This lead shipping companies to go through a period of ‘game of chicken’ as imports began to rise.

(2) Key Shipbuilding Equipment Import and Export Trends by Region

In the case with ships, careful attention to statistical analysis of domestic demand is necessary. An examination of shipbuilding industry-related equipment is also essential. This report will analyse the following equipment: marine engines((HS-840810), propellers(HS-84871000) and general-use anchor parts(HS-731600), the Ballast Water Management System(BWMS)(HS-84212191) – which is now mandatory due to environmental regulations enforced beginning 2019, and cranes and derricks(HS-8426).

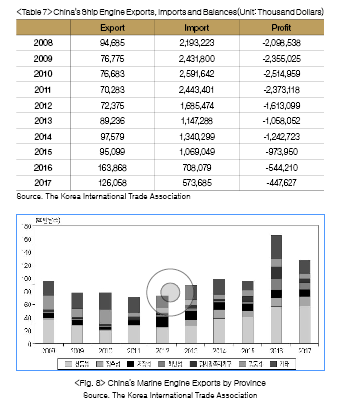

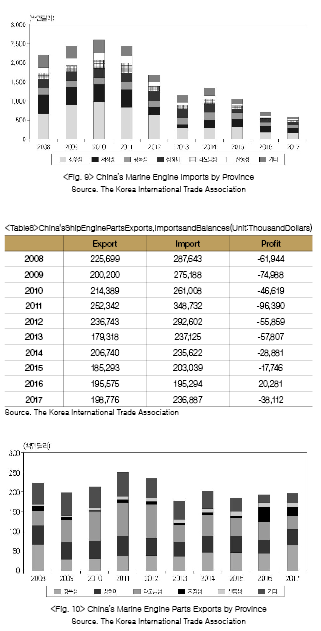

Marine engines are one of China’s main imports and also a cause for the industry’s trade deficit as global ship owners prefer engines from recognised countries such as South Korea, Japan, and Germany. However, Chinese companies were able to secure technology and production licences through cooperation with European companies. As a result, despite the shipbuilding industry’s recession, China was able to increase its exports until 2016.

Relative to China’s shipbuilding industry’s production peak in 2011, marine engine imports would have peaked in 2010. According to Clarkson’s statistics, in 2017, China’s shipbuilding volume was only 56% of its peak production. Also, even if the price drop is factored in, and considering that imports were only 22% of its height. As a result of low import figures, it can be presumed that significant portions of Chinese-manufactured engines were equipped with imported parts.

China’s major export markets of 2017 can be listed into the following(from largest-to-smallest): Bangladesh(14%), India(12%), Philippines(11%), and Vietnam(10%). China’s major import markets for the same year reflected its reliance on global marine engine manufacturers, again listed from largest-to-smallest: South Korea(45%), Japan(22%), the U.S.(9%), and Finland(5%).

On a provincial level, China’s 2017 exports were ranked as follows: Shandong, Jiangsu, and Zhejiang, with regions with high exports having CSIC’s DMD Engine factory and CSSC’s presence.

Marine engine imports were focused around areas with shipyards. China’s 2017 imports were ranked as follows: Jiangsu, Zhejiang, Guangdong, Shanghai, and Liaoning.

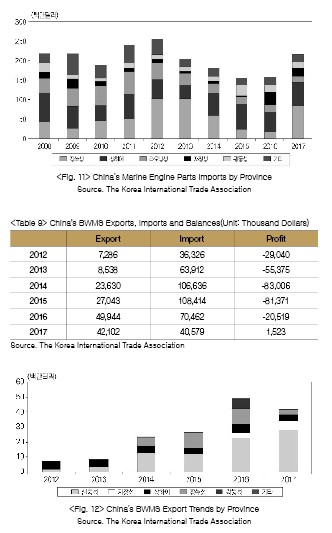

Regarding marine engine parts, China’s exports remained at pace with engine production and parts manufacturer growth. Previously, imports were steadily declining, but have picked-up rapidly in recent years. In 2016, Chinese companies recorded a trade surplus from the rising competitiveness of domestic companies.

In 2017, China’s main export markets were predominantly engine manufacturing countries or countries with advanced shipbuilding and repair industries such as Japan (15%), South Korea (14%), Singapore (8%), Germany (6%). On the other hand, China’s main import markets were predominantly engine manufacturing countries such as South Korea (39%), Germany (18%), Japan (12%), Finland (7%), and Austria (7%).

China’s marine engine parts exports were predominantly from regions with the presence of shipbuilding equipment manufactures such as Jiangsu, Shanghai, Liaoning, Zhejiang, and Shandong. Marine engine parts imports were mostly from areas with marine engine manufacturers such as Jiangsu, Shanghai, Liaoning, Zhejiang, and Guangdong. Propellers, which require highly-skilled labour to produce, was another contributor to the industry’s trade deficit.

In 2017, China recorded a trade deficit of $160 million. China’s propeller imports were from(greatest-to-smallest) Japan(29%), Germany(19%), Finland(17%), Norway(9%), and Denmark(7%). Although China’s general-purpose parts exports were growing, it was still reliant on high-value-added products imports.

Marine propeller exports were predominantly based out of Jiangsu, home to Wartsila CME Zhenjiang Propeller, a joint venture between Wartsila and CSSC. Propeller imports, like engines, were active in Jiangsu, Guangdong, Shanghai, Shandong, and Zhejiang, where major shipbuilders and repairers are located.

Except for specialized ship moorings, anchors and general parts are China’s surplus-making products as they do not require highly-skilled labour. In 2017, exports were mostly made to major shipbuilding and shipping countries such as the U.S.(24%), South Korea(8%), Japan(8%), Norway(6%), and the UAE(4%). Although some imports were made from the Netherlands, the UK, and Japan, they were mostly offshore plant or specialized ship-related imports.

Upon examining exports by province, exports were active in provinces with the presence of a marine equipment industry or a steel shipbuilding industry such as Shandong, Jiangsu, and Zhejiang. However, restructuring within steel-related industries negatively affected Shanghai and Jiangsu, which showed decreasing trends, while Shandong and Zhejiang’s exports grew.

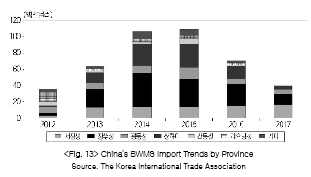

The BWMS was once a deficit-making product for China, but beginning in 2017, it has profited China as exports exceeded imports. In 2017, BWMS exports were mainly to major shipbuilding, ship repair, and shipping countries such as South Korea(29%), Japan(19%), Singapore(12%), Taiwan(12%), and Hong Kong(8%). Imports were from South Korea(54%), the U.S.(14%), Germany(13%), and Norway(4%). Initially, BWMS’s were imported from technologically advanced countries, but as the number of new constructions contracted and the quality of China’s products improved, domestically manufactured goods were increasingly installed onto vessels.

Upon examining provincial export trends, provinces with a well-developed shipbuilding equipment industry, such as Shandong and Zhejiang, were able to realize active exports. Imports were mainly made from Zhejiang, Jiangsu, Guangdong, and Shanghai. Initially, imports were made on a large-scale to cater for newly constructed ships; however, recent imports were to replacement parts of vessels undergoing maintenance.

Crane and Derrick are used for many shipping and onboard purposes. In 2017, exports were to Singapore(11%), the UAE(9%), Indonesia(6%), India(6%), and the U.S.(5%). They were not only exported for its use as a crane, but also many other applications. Essential parts were imported from technologically developed countries in Europe, such as Austria(15%), Germany(14%) and the Netherlands(10%).

Upon examining provincial export trends, exports are recorded in provinces with a well-developed machinery industry and shipbuilding industry such as Shanghai, Jiangsu, Hunan, and Liaoning.

■ Will continue next month.

- 이전글ClassNK grants AIP on LPG Reformer for marine engines 19.11.15

- 다음글The future-proof ship 19.11.15