Feature Story Denmark Ship Ballast Water Treatment System Market Trends

페이지 정보

작성자 최고관리자 댓글 0건 조회 6,960회 작성일 19-06-07 11:15본문

1. Product name, HS code: Ballast Water Treatment System (BWTS), HS84221

The Ballast Water Treatment System(BWTS) is a device which removes and disinfects (micro)organisms from the ballast’s water. It also prevents foreign organisms from different regions from entering local waters.

Large ships often fill their ballast tanks with water to allow it to partially submerge. In this way, ballast water is injected and discharged from the ballast tank to balance the ship according to the load. In the case of large container ships, approximately 100,000 tons of ballast water is required. When ships arrive at the port to unload cargo, ballast water from different regions are discharged into the sea.

During this process, foreign (micro)organisms have the potential to damage the local marine ecosystem. BWTS’s widely use electrolysis, ozone spraying, ultraviolet (UV), or chemical treatments.

2. Market size and trend

BWTS market expansion was expected following the International Maritime Organization’s(IMO) agreement in 2004 to prevent damage to local marine ecosystem’s from ballast water discharge by mandating BWTS on all vessels. However, installing BWTS to over 50,000 ships was deemed physically impossible, as a result, in 2017, the IMO agreed to extend the deadline to 2024, effectively slowing expected market growth.

Under the agreement, all dry-docked vessels are obliged to install the BWTS, and all operational vessels will be obliged to install the BWTS when they dry-dock to undergo their inspection every five years. However, as the mandatory installation period was extended, vessels dry-docking before September 8, 2019, will not obliged to install the BWTS, and vessels having already passed inspections are only required to install the BWTS before September 8, 2024.

(1) Global market size

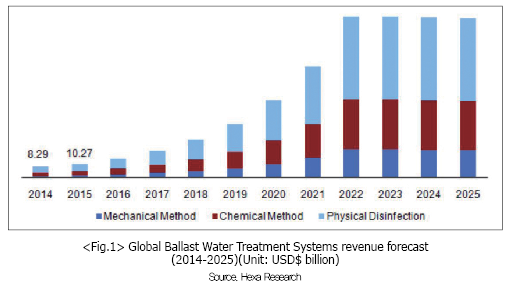

In 2016, the global BWTS market was worth an estimated USD $14.2 billion. Driven by the IMO agreement and growing global trade, the market is growing at 25.2% YoY, and is expected to be worth over $117.6 billion by 2025. In particular, growth in North America is expected to reach $59.5 billion by 2025, closely followed by Europe and then Asia.

BWTS is a high-end product costing on average $400,000 per unit. Globally there are 65 BWTS manufacturers. The filtration and UV disinfection system leads the BWTS market. (Marked in Figure 1 as ‘physical disinfection’) Although, UV disinfection systems, compared to electrolytic, and chemical disinfection systems, are disadvantageous in murky waters, performance is constantly improving. However, UV systems lead the market due to lower costs and smaller space utilization.

Electrolysis(EL) and electrochemical(EC) systems are understood to be especially advantageous in bulk carriers and large oil tankers.

On the other hand, the equipment replacement cycle from deterioration is expected to take 10 to 12 years, with a development time of five years and development costs between USD$8 to 10 million.

(2) Denmark

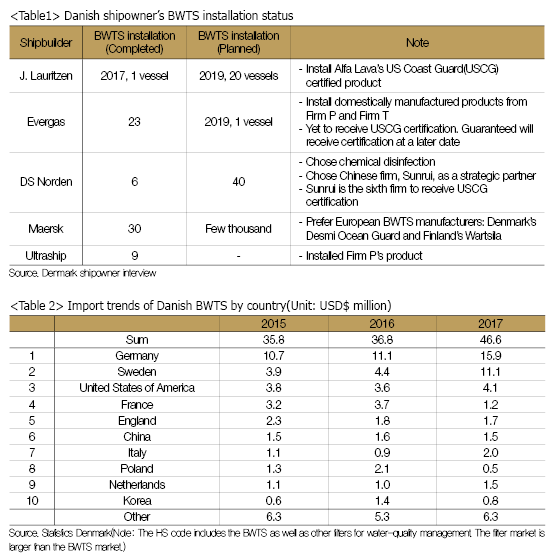

As of 2018, there were an expected 950 Danish national vessels, with numbers expected to increase to 1,125 by 2028. As a result, demand for BWTS in Demark is expected to be significant.

3. Scale of imports for the past three years and import trends of top 10 countries

Statistically, Germany and Sweden account for the majority of imports. However, given that most work is carried out in countries where shipyards are located, the following statistics are meaningless for Denmark. There are no large-scale shipyards in Denmark, and installation work is carried out at ship’s country of origin according to its schedule, therefore delivery is made to that country.

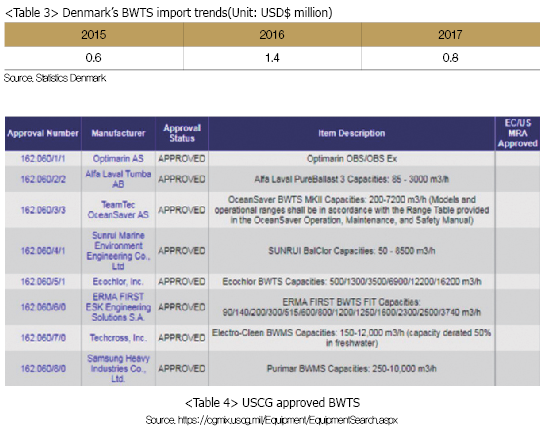

4. Demark import size and trends

As mentioned previously, most products are exported directly to the ship’s country of origin, as a result, imports to Denmark are considerably low.

5. Competition trends and major competitors

The global BWTS market is a highly competitive market based on price, quality and market positioning. Competition is intensifying between various developed countries and regions such as the US, Europe and developing Asian counties. Norway’s Optimizer has attempted to become a market leader by offering a 5-year service guarantee, ahead of the IMO’s implementation of environmental regulations.

Related companies include Alfa Laval(Sweden), Panasia(Korea), OceanSaver(Norway), Qingdao Sunrui(China), JFE Engineering(Japan), Qingdao Headway Technology(China), Optimarin(Norway), Hyde Marine(United States of America), Veolia Water Technologies(France), Techcross(Korea), Siemens(Germany), Ecochlor(United States of America), Industrie De Nora(Singapore), MMC Green Technology (Norway), Wartsila(Finland), EI Treatment Systems(United States of America), Mitsubishi Heavy Industries(Japan), Desmi(Denmark), Trojan Marinex(Canada).

IMO certification is a must, and USCG certification is required when calling US ports. Ship owners prefer BWTS’s with USCG certification, as a result, BWTS manufacturers are focusing their efforts on obtaining USCG approval. Currently, there are eight Korean companies with USCG certifications, including Techcross and Samsung Heavy Industries. Over the next one to two years, additional product approvals are expected.

6. Distribution structure

It is under the ship owner’s discretion to decide which BWTS to install. The ship’s owner usually receives advice and opinions from the ship’s builder when deciding which BWTS to install in their new ships. In addition, agents can market directly to the ship’s owner. Agents include the Berg & Larsen Group (http://berg-larsen.com/website/) and Hausschildt Marine a/S (http://www.hauschildtmarine.dk/).

7. Relevant certifications and tariff rates

(1) IMO certification, as well as USCG certifications for operations within US waters, are required.

(2) Tariffs for Korean products are 0%.

8. Implications

As mentioned above, competition is intensifying in the US and Europe as well as developing countries such as China. As the IMO convention nears full effect, the existing market will open-up and rapid growth is expected until 2024.

Danish shipowners prefer USCG-certified products for its stability. Therefore, it is necessary to quickly acquire the certifications and market actively. The Danish Shipowners Association emphasizes that there is a high possibility that market growth will be temporary and limited(mainly around maintenance following installation), and in the process of market stabilization, reorganization will be focused around the market leaders.

Accordingly, it is recommended that Korea’s KORMARINE, China’s Marinetec, and Norway’s Nor-Shipping participate in exhibitions attended by Danish ship owners.