Special Report LNG Carrier Value Chain and Competitive Advantage Analysis ①

페이지 정보

작성자 최고관리자 댓글 0건 조회 3,146회 작성일 20-10-15 16:33본문

1. Industry Summary and Liquified Natural Gas(LNG) Carrier Summary

(1) Shipbuilding Industry and LNG Carrier Summary

① Shipbuilding Industry Summary and Characteristics

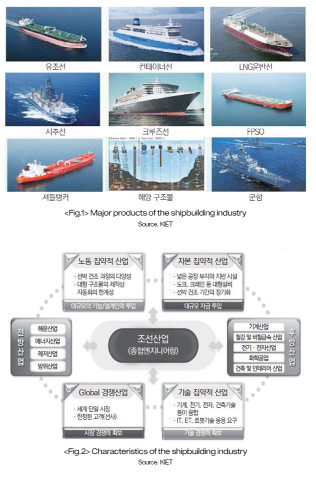

The shipbuilding industry is a knowledge-based and engineering-centric industry consisting of a diverse range of vessels, offshore structures, and related equipment as well as relevant research and development(R&D), design, and manufacturing. The industry is categorised by vessel type, cargo-specialisation, and the manufacturing process. Cargo-specialised vessels are sub-categorised into container ships, oil tankers, bulk carriers, LNG and Liquified Petroleum Gas(LPG) carriers, roll-on/roll-off(RORO) ships, and passenger ships. Offshore structures are sub-categorised into seafloor operations vessels for resource development and production, exploratory vessels, oil rigs, and fixed/floating oil and gas production equipment(FPSO, FSRU, Platform, TLP, SPAR 8). The industry is also inclusive of leisure vessels, fishing vessels, icebreakers for polar navigation, and military-use submarines and special operations vessels. Additional equipment such as electric/ propulsion systems, support and communication equipment, docking and (un)loading equipment, mooring and safety equipment as well as other fittings are also considered a part of the industry.

The shipbuilding industry is a comprehensive industry capable of large ripple effects into front-facing sectors such as energy, shipping, fisheries, defence and into rear-facing sectors such as machinery, steel, electronics, and chemicals. The industry is also capital intensive deriving from optimal technological capacity, a specialised workforce, investments towards large equipment such as moorings, docks, and cranes, and significant operational investments to support construction. It is essential to account for the considerable upfront costs associated with the construction process such as material purchases and labour costs for two-year-long ship construction projects and the three to four-year-long offshore plant construction projects.

A ship’s owner or shipping company orders a ship which is constructed upon order for business purposes or upon request by owners. Given the numerous variants, mass production of ships is not feasible. Shipping companies generally utilise “Flags of Convenience” by registering vessels in countries such as Panama and Liberia to sidestep regulations and reduce costs.

A ship is designed and constructed with the route or the ship’s purpose in mind. The industry, as a whole, is responsible for providing safe navigation, escape routes during emergencies, and mitigating environmental pollution per international standards. Key environmental protection standards include the Safety of Life at Sea(SOLAS) Convention and the International Convention for the Prevention of Pollution from Ships(MARPOL). In addition to the mentioned standards, the International Maritime Organisation(IMO), the International Labour Organisation(ILO), and respective governments have predetermined standards for vessels during the design and manufacturing phases to reinforce safety and environmental protection.

On the one hand, the implementation of core technologies from the Fourth Industrial Revolution will undoubtedly increase the cost of vessels in the short run. However, the long-term cost-saving benefits in the long run for both the shipping company and the consignor are far greater. Core technologies of the revolution include Digital Twin, Autonomous Navigation, Intelligent Repair and Maintenance, Remote Navigation, Common Platform Technology and Cyber Security.

In this research, LNG carriers are considered a high-end class of cargo ships given the advanced technologies required to construct this high value-added vessel. As such, English shipbuilding and shipping consultant, Clarkson, classes LNG carriers as ‘Specialised Vessels’.

② Summary of LNG carriers

LNG carriers are vessels which transport natural gases cooled to-163℃ and compressed to 1/625 of its normal volume. LNG carriers were first introduced in the 1950s through 5,100m2-class ships, and later-on, larger, 268, 000m2-class ships. As LNG carriers transport liquids at very low temperatures, the cargo holds are made with nickel or stainless steel. However, high-manganese steel recently developed by POSCO is gradually being used for the cargo hold. The LNG must be maintained at -163℃ as a slight increase in temperature could cause evaporation; as such, the cargo hold is covered in several layers of insulation.

The heat exerted on the outer layer of the hold cannot be completely blocked-out, causing a 0.15% daily evaporation of the cargo during transportation. The evaporated gas has the potential to explode; as a result, the gas must be retracted and used to fuel the ship, re-liquified into the hold, or boiled-off. LNG carriers are categorised into Moss-type, Independent-type and Membrane-type carriers. Initially, global demand favoured Moss-type carriers; however, the trend has shifted towards Membrane-type carriers. Moss-type carriers are safer as they minimise sloshing, but their capacity is far lesser compared to their counterpart and also cost more.

Korea’s major shipyards have various LNG carrier construction capacities such as Hyundai Heavy Industries’ construction capacity for Moss-type and Membrane-type(MarkIII) carriers, Samsung Heavy Industries’ construction capacity for GTT Mark III Membrane-type carriers, and Daewoo Shipbuilding’s construction capacity GTT No.96 Membrane-type carriers.

The propulsion systems is an integral technology of LNG carriers. For 40 years until the mid-2000s, Japanese-made steam turbine carriers dominated the market. However, due to low fuel efficiency, four-cycle, dual-fuel engines were developed and used on vessels beginning in 2004. By 2008, triple fuel engines were developed and used; by 2016, two-cycle MEGI engines were developed and commercialised; and in 2017, the X-DF engine was developed and is the market leader to this day.

(2) LNG Carrier Market Structure

① The Consumer

- Direct Consumer

Direct consumers of LNG carriers are generally the ship’s owner or the shipping company with most recent orders coming from Greek shipping company, Maran Gas Maritime.

At June 2019, Maran Gas Maritime had ordered 13 vessels, while another Greek company, Cardiff Marine, had 11 outstanding orders. Orders for both companies were made with Korean shipbuilders. On the one hand, Japan’s Mitsui OSK Lines(MOL) had the third most orders with four vessels ordered with Japanese shipbuilders, two with Korean builders, and four with Chinese builders. Four of MOL’s order are with Shanghai Changxing Shipbuilding(SCS), these are likely from MOL’s long-term agreement to transport China’s LNG.

Major LNG transporting companies are registered in Bermuda, Monaco or other countries to utilise Flag of Convenience, which helps companies avoid taxes, make employment easier, and reduce costs. Korean companies are no exception - SK Shipping, SM Shipping, and Hyundai LNG Shipping are all registered in Panama. The largest LNG shipping company, by registered vessels, is Bermuda’s Teekay, followed by Japan’s MOL and Qatar’s Qatar Gas. Qatar Gas transports the most gas, by volume, as its entire fleet consists of ultra-large carriers over 200,000 CBM. Upon investigating into the actual owners of LNG carriers registered under Flags of Convenience, Greece has the largest fleet worth $184 billion, followed by Japan’s fleet worth $153 billion, and China’s fleet worth $58 billion.

- Indirect consumer

Indirect consumers of LNG carriers consist of domestic players such as national and private gas companies with interests in importing and exporting LNG. National level importers of LNG are increasingly concerned with securing natural gas as a key energy source by entering into long-term contracts based on domestic demand. An LNG carriers route between two countries holds significance as the vessels themselves are the key link between the natural gas’s producer and the final consumer.

Following the development of shale gas extraction technologies in 2009, the US overtook Russia as the number one producer of natural gases. However, most US-produced gases were consumed domestically, as such, the top global exporter of natural gases was Qatar, and the leading importer remained Japan.

Upon examining the trade route from producer to the final consumer, approximately 60% of natural gases was transported on land through pipelines. In contrast, the remaining 40% was transported over water by liquifying the gases. Proximate inter-regional transport to the US and Europe, the gases are transported as Piped Natural Gas(PNG), while gas destined for Asia is transported as LNG.

As mentioned above, natural gases are cooled and compressed for transport on ships and reevaporated upon arriving at the final destination to be distributed through the local gas network for final consumption. Due to this intricate process, LNG was costlier than PNG. But in 2007, following Qatar’s large gas field development projects, the price of LNG was brought down enough to compete with PNG allowing for competitive exports to Europe. Upon examining the LNG value chain, countries with gas fields jointly conduct explorations with energy companies, the produced gases are liquified and stored, the shipping companies then transport the LNG to the final destination where the LNG is reevaporated ready for final consumption.

In this research, the LNG carrier’s value chain predominantly focuses on the vessels used during the transportation process. Also, for reference, Korea has several gas import terminals operated by the Korea Gas Corporation at Incheon, Pyeongtaek, Tongyong, and Samchuk, POSCO’s terminal at Gwangyang, and SK and GS’s jointly terminal at Boryeong.

Korea’s privately-owned energy companies, SK E&S and GS, are also in the gas energy business and are looking to expand into owning and operating their gas terminals. POSCO-Daewoo is also looking to capitalise on the growing demand for gas energy in Asia by leveraging their gas trading expertise to explore and develop its capacity with Petroleum Brunei.

② The Supplier

- Builders of LNG carriers

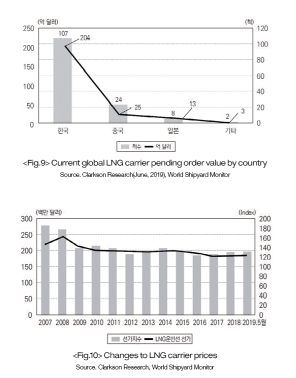

Korea’s key LNG carrier suppliers are the three major shipbuilders. In September 2019, they accounted for 85.7% of the global pending order contracts on a dollar-value basis. On a vessel-unit basis, of the 134 pending vessels, the three shipbuilders accounted for 103 vessels(76.9%) with the remaining 31 vessels were with Chinese and Japanese shipbuilders. The majority of ships ordered in China and Japan are a result of domestic demand from shipping companies.

China’s major suppliers are China State Shipbuilding Corporation(CSSC), Hudong Zhonghua Shipbuilding, and SCS. Other suppliers do exist but are limited to smaller vessels. Of the major Chinese shipbuilders, only Hudong Zhonghua has experiences in constructing large LNG carriers. However, SCS is currently in the process of constructing five vessels for Mitsui OSK which has been contracted to transport LNG for China.

Japan’s LNG carrier construction-capable shipyards are heavy industry companies such as JFE, IHI, Japan Marine United(JMU), Mitsubishi Heavy Industries, and Kawasaki Heavy Industries. Upon comparing the LNG supplier’s value chain, business performance, and business area, the once highly active Asian shipbuilders have experienced a relative fall in performance. For example, aside from Daewoo Shipbuilding’s offshore business which restructured its order change design structure, leading to reasonable costs and high self-preservation efforts, other suppliers have recorded losses. It is presumed that the cost of most ship types, compared to previous highs, are down 24-45% as a result of efforts to maintain appropriate levels of operational facilities and manpower despite falling demand.

The performance of Hudong Zhonghua and SCS, both subsidiaries of CSSC, although cannot be individually compared, is cumulatively satisfactory. On the other hand, Japan’s JMU and Kawasaki have both shown sub-par performance.

- LNG carrier value chain and supplier structure

An LNG carrier supplier’s value chain is separated into construction, related processes such as metalwork and launching, delivery, marketing, execution of construction contracts, and servicing. Each value-creating activity consists of wages(labour costs), management costs, and fees, which are created from activities such as procurement, R&D, design, transportation, communication, and depreciation.

In the shipbuilding industry, the construction cost varies based on ship type. On average, 50-65% of costs arise from steel, engine, and equipment costs; 30% of costs arise from labour costs(inclusive of outsourcing), and the remainder consists of interest and depreciation costs. In the shipbuilding value chain, the procurement of parts and materials, labour productivity, and economies of scale in operations are key contributory factors to the economic effect, which explains the reasoning behind the concentration of production to specific regions.

The LNG carrier value chain is categorised into stages such as R&D, design and engineering, materials, parts, construction, demand from shipping companies, servicing, and maintenance. Korea’s major LNG carrier builders, Hyundai Heavy Industries, Daewoo Shipbuilding, and Samsung Heavy Industries, all have R&D, design and engineering as well as construction capacities. Concerning materials, the mentioned companies all have LNG carrier cargo hold-related material and metals capable facilities.

In relation to demand from shipping companies, demand in Korea is from Hyundai Shipping, SK Shipping. Global demand is from Maran Gas Maritime, Alpha Gas, Arctic Green LNG, BW Gas, Teekay, and MOL with repairs and services usually carried out in Singapore and China.

③ Current state of major market sectors and outlook

The once global LNG carrier market-leading Korea’s shipbuilders are currently facing fluctuations to their orders. However, orders are on an upward trend following the increased demand for environmentally friendly energy options. Orders were down in 2019 but will likely increase 112% in 2020 to recover to near-2018 levels.

This LNG carrier market boom is expected to record over $150 billion in 2020, and record over $170 billion in 2028, a 2019-2028 annual average order value of $140 billion.

Demand for steel, which accounts for 10.3% of an LNG carrier’s cost, rose to $1.3 billion in 2018 and is expected to rise to $1.7 billion in 2028, a 2019-2028 annual average demand of $1.45 billion. Demand for the carrier’s engine, which accounts for 10% of the vessel’s cost, rose to $800 million in 2018 and is expected to rise to $1.3 billion in 2028, a 2019-2028 annual average demand of $880 million. Demand for equipment, which accounts for 24.3% of total costs, is expected to be annual average of $3.4 billion between 2019-2028. Piping is expected to account for $760 million, interior fittings and equipment accounting for $80 million, electrical equipment and fittings accounting for $200 million, metal works accounting for $320 million, and other equipment accounting for $1.6 billion. As such, the total LNG carrier equipment market was worth $7.9 billion in 2019 but is expected to rise to $10.3 billion in 2028.

Upon examining the global ship repair and remodelling markets, they were cumulatively worth approximately $16.5 billion in 2017. Considering the demand for ship repairs and demand for remodelling from strengthened IMO environmental regulations, global demand is expected to rise to $25 billion.

The environmental protection regulations such as the Ballast Water Management Convention which came into effect in September 2019 and the Sulphur Oxides Regulation which came into effect in January 2020 are expected to trigger a growth in the remodelling market from 2019 to 2023.

The LNG carrier repair market was worth $830 million in 2017 and is expected to be worth $910 million in 2020. The market is expected to be worth $1.4 billion in 2030, driven by increasing testing costs.

Unlike the new construction market, given that the navigational rate of operation is directly related to the shipping company’s revenue and profits, ships need to be repaired at yards on the ship’s route to minimise unnecessary costs. In the case of middle- to large-sized ships such as LNG carriers, the cost of repair is high. Repairs are usually carried out at locations which take into account the loading and unloading of cargo, the route, and the opportunity cost of repairs. Korea’s LNG carriers, given that the majority of imports are from Qatar, repairs are usually carried out in Singapore.

※ Will continue next month.