Feature Story Chinese shipbuilding industry poised to make a leap forward

페이지 정보

작성자 최고관리자 댓글 0건 조회 9,139회 작성일 19-05-29 17:59본문

Global shipbuilding industry is currently undergoing severe restructuring amid deterioration of world economic conditions. Unfavorable economic conditions tend to weaken the demand for shipping, which leads to adjustment in terms of the timing for ship demand. As a result, business cycle in shipbuilding industry is much wider than economic cycle. Therefore, survival is the key issue during the period of recession.

1. Current status of shipbuilding industry

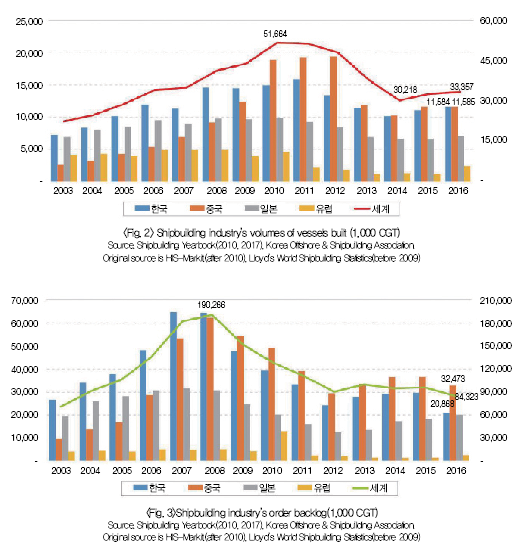

The three major indices of shipbuilding industry show that the volumes of vessels built has not recovered to date amid the decline in the demand, which resulted from the global financial crisis at the end of 2007, since it reached the peak in 2010.

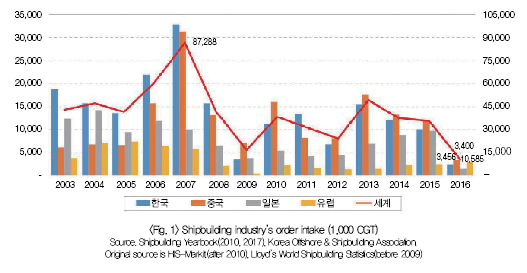

Due to glut of supply, China, Korea and Japan, the major shipbuilding countries, are proceeding with restructuring. New order intake plunged after reaching an all-time high in 2007(from about 87.29 million CGT in 2007 to 10.59 million CGT in 2016). Korean shipyards took top spot in terms of new order intake until 2008, but were dethroned by Chinese shipyards from 2009.

The volumes of vessels built peaked at 51.66 million CGT in 2010 and continued to decline to 30.22 million CGT in 2014 before slightly rebounding recently. Korea ranked the first until 2009 in terms of volumes of vessels built, but was outstripped by China from 2010. The gap between the two countries has recently been narrowed. The order backlog has been declining to 190.27 million CGT in 2008, and by the end of 2016, Chinese shipyards claimed top spot with 32.47 million CGT.

Global shipbuilding industry has been dominated by China, Korea, and Japan and has seen the competition being intensified between Korea and China over their flagship vessel segments.

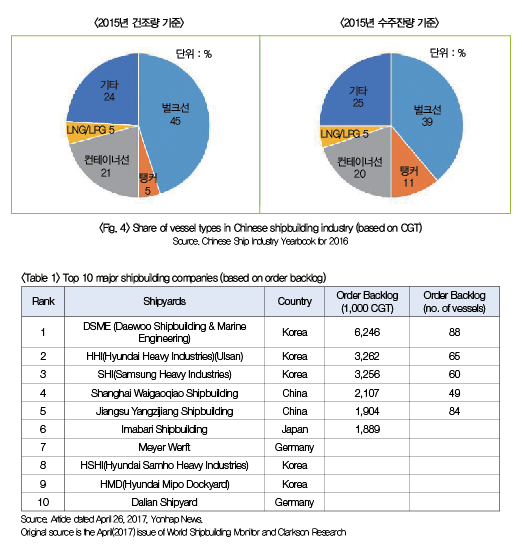

Chinese shipyards saw that the share of bulk carriers and containerships comprised about 66% based on volumes of vessels built and 59% based on order backlog in 2015. In terms of volume of vessels built, bulk carriers comprised 45% and containerships accounted for 21% while LNG/LPG carriers made up 5%. In terms of order backlog, the share of bulk carriers decreased to 39% while the share of tankers increased to 11%, which are expected to lead to changes in vessel types. According to data from Clarkson data, 5 Korean shipyards ranked first, third, eighth, and ninth in order backlog, as of late March 2017, among top 10 global shipyards.

As Shanghai Waigaoqiao Shipbuilding and Jiangsu Yangzijiang Shipbuilding are ranked the 4th and 5th, respectively, it has been proved that most Chinese shipbuilders are large and medium-sized.

2. Comparison of competitiveness between Korean and Chinese shipyards

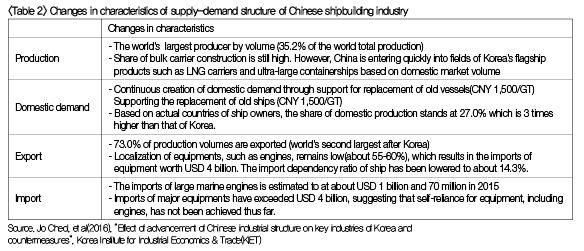

Chinese shipbuilding industry is currently disposing of overproduction facilities for supply side structural reforms. To strengthen industrial competitiveness, the Chinese shipyards are focusing on upgrading their flagship vessels into high value-added vessels.

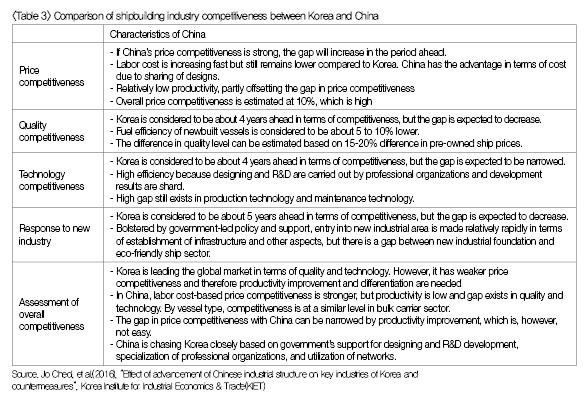

As ship engines, for example, are still dependent on imports, major core technology development is urgent. Chinese government are providing subsidies for replacement of old vessels with eco-friendly vessels by 2017, along with 17% export tax rebate(VAT), in an endeavor to promote advancement of shipbuilding industry. Comparing the competitiveness of shipbuilding industry between Korea and China, China has stronger price competitiveness while Korea has slight advantage over competitiveness in terms of quality, technology and response to new industry. However, this gap is expected to be narrowed. According to the report published by the Korea Institute for Industrial Economics & Trade(KIET) in 2016(Jo Cheol, et al., 2016), China is considered to have approximately 10% price competitiveness in vessels of same kind.

China is steadily expanding its R&D(research and development) efforts in the fields of ship design and engine, etc., rapidly narrowing the gaps of technology and quality competitiveness in which Korea has advantage. As China has achieved competiveness on a par with that of Korea in bulk carrier segment, competition is expected to become fierce in the fields of ultra-large containerships and LNG/LPG carriers, the flagship vessels of Korean shipyards, over the next 5 years. Korea is better positioned in the eco-friendly manufacturing sector and is expected to maintain its competitive edge for the time being. However, both countries need to actively respond to new production conditions.

3. Analysis of Chinese shipbuilding industry in the first half of 2017

In 2017, China's shipbuilding industry was faced with fundamental problems such as decline in new orders and order backlog with increased shipbuilding volumes amid recovery of crude oil prices and deterioration of the balance sheet in the first half of the year.

In the first half of 2017, volumes of vessels built stood at 26.54 million DWT(an increase by 57.4% compared to the same period of the previous year), and order intake reached 1,151DWT(a decrease by 29% year-on-year), while the order backlog reached 8,284 DWT(a decrease by 30.5% year-on-year) which represents a significant decline from the level recorded in late 2016. Ship exports grew 65.5% year-on-year, and industry profit turned relatively stable. Total production of major 80 shipbuilders reached CNY 185 billion, while exports amounted to CNY 73.2 billion, a decrease by 6.6% and 12% year-on-year, respectively.

A close look at characteristics of Chinese shipbuilding industry shows that China has laid the groundwork for constant growth based on massive orders for state-of-art vessels and effect of restructuring.

Chinese shipbuilding industry made a turning point by winning new orders for high value-added vessels such as LNG carriers and VLGCs(Very Large Gas Carriers), etc., in the first half of the year. As the shipbuilding industry showed strong performance, Chinese shipyards delivered VLCCs(Very Large Crude Carriers), transport vessels and containerships, adding vitality to shipbuilding industry.

Chinese shipbuilding industry is moving ahead with offshore plant/deep sea offshore plant development and market reinvigoration efforts as part of industrial restructuring while striving to reduce costs and improve profitability. Mid-sized shipyards are improving their profitability through active utilization of existing facilities while small and mid-sized shipyards are establishing technology development centers in an attempt to shift the focus towards a manufacturing service.

Despite global economic slowdown, new orders slightly increased in 2017 on the back of the rising demand in the shipping industry. The glut in the supply of containership is likely to continue, but the demand for bulk carriers, small- and medium-sized containerships, and special purpose vessels, etc., is expected to increase amid the recovery of crude oil transportation market.

Among the problems faced by Chinese shipbuilding industry are included the financial distress, rising wages, anxiety about order backlogs, and decline of Chinese flagship vessel segment.

The demand for financing at policy level is increasing due to lack of liquidity in shipbuilding industry, and the instability in the industry has remained persistent in the midst of resultant contraction of financial market which is concerned about bad loans. Therefore, it is urgent to provide support to competitive shipyards through differentiated financial policies. The equipment manufacturing segment has been hit hard amid bankruptcy of some companies and delay in business as a result of the shrinkage of marine process equipment market. For a leap towards the marine power, a series of factions need to be taken, such as credit insurance, ship export credit insurance extension, loan default deferment and lending at low interest rate.

As the demand has recently increased for renewable energy that can replace fossil energy sources, mid and long-term measures would need to be taken to cope with new international norms that the International Marine Organization(IMO) is crafting, such as Global Warming Rule, Energy Efficiency Design Index(EEDI), etc. As a result, the industry is proceeding with reduction in overproduction facilities, adjustment of inventory assets, and shift towards smart production facilities through constant industrial restructuring.