Feature Story Trends of Russia’s

페이지 정보

작성자 최고관리자 댓글 0건 조회 5,799회 작성일 19-05-29 15:38본문

1. Scale and trend of market

(1) Structure of Russia’s shipbuilding industry based on 2016

Currently, there are more than 2,200 companies, including subcontractors, in Russia’s shipbuilding industry which has been creating over 700,000 jobs.

As of late 2016, Russia’s share in global shipbuilding production is as low as 0.6%. Particularly, Russia has seen its private-sector shipbuilding industry relatively lagging behind its military sector(such as warships and submarines, etc).

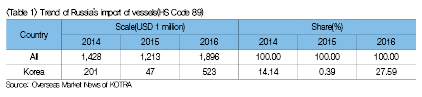

(2) Scale of Russia’s import of vessels

Russia’s import of vessels stood at approximately USD 1.9 billion in 2016. Korea, importing vessels worth about USD 520 million from Russia, is the largest importer.

(3) Repair shipyards under construction due to shortage and aging of fishing boats

Russian government considers it necessary to build 360 fishing boats by 2030, which will require the funds ranging between USD 10 billion and 12 billion. 30% of approximately 1,200 Russian fishing boats are over 30 years old, with an average age of 28 years. Since 2009, only 16 fishing boats have been built in Russia(10 of them are small-sized). There are about 5 shipyards in Russia that can build fishing boats, and about 2 to 3 fishing boats can be built a year. Of these, there are 3 shipyards that can build large trawlers. The shortage of fishing boats in Russia and aging are expected to come to the fore by 2020. Therefore, local governments in the Far East are also attempting to build fishing boats by reconstructing repair yards.

(4) Shipbuilding industry clusters in Saint Petersburg

The volumes produced by existing clusters stood at USD 1.5 billion in 2015, and the government is striving to develop new clusters. A project is planned to develop shipyards in Vyborg. The Leningrad Government is preparing to develop a new shipbuilding cluster that includes both shipbuilding and ship repair companies in 2017 (Source: Kommersant).

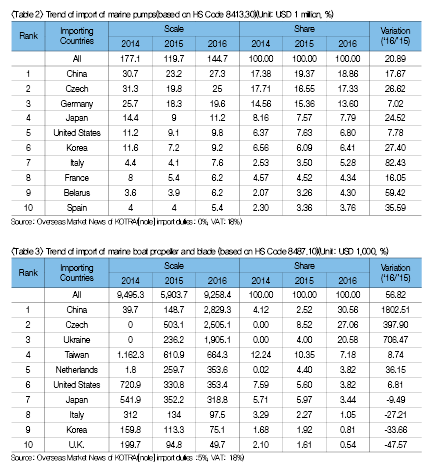

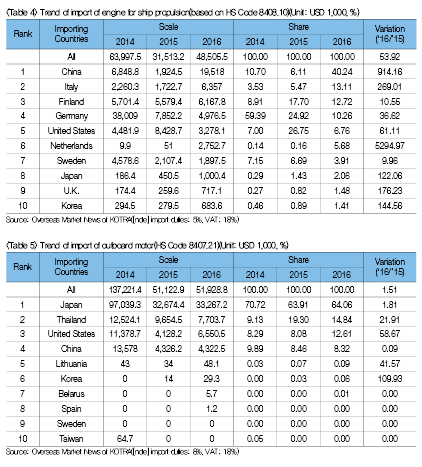

2. Scale and trend of import from top 10 countries over the last 3 years

For the marine equipment industry characterized by many exceptional situations, it is difficult to express the situations based on a HS Code and also difficult to obtain unified statistics figures. Table 2 through 5 shows the scale of imports from Russia and the products with high share of import from Korea.

. Trend of competition and major competing companies

In Russia, there are 6 shipyards and repair yards in northern region, 20 shipyards and repair yards in western region, 13 shipyards and repair yards in eastern region, and 5 shipyards and repair yards in southern region. Among the private-sector factories, Vyborg shipyard is the leading shipyard specializing in fishing facilities. Besides, there are Yantar shipyard in Kaliningrad, Severnaya Verf shipyard in Saint Petersburg, Oka shipyard and Krasnoe Sormovo shipyard in Nizhny Novgorod.

4. Policy trend

(1) Russian government’s shipbuilding industry development policy

Russian government’s long-term program titled ‘2013-2030 Shipbuilding Industry Development’, for which a budget of approximately USD 1.1 billion will be set aside, was approved in 2012 and aims to promote localization of marine equipment so as to develop Russia’s domestic shipbuilding industry. In March 2017, the project was renamed to ‘Shipbuilding and equipment development in marine sector’.

(2) Law on investment quota for Russian fishing boats

Following the approval of concerned legislation in May 2017, the Russia’s Federal Agency for Fishery implemented the investment quota program for companies building new fishing boats and companies building fishery product processing factories in Russia in an attempt to improve aging vessels and develop the fishery market.

Under this program, at least 100 fishing boats and 10 fishery product processing factories are expected to be built. In addition, this program will boost Russia’s fishing boat production capacity by 40% and increase annual contribution of fishing industry to Russia’s gross domestic product(GDP) by more than USD 8.4 billion. Russian government plans to allocate 20% of total allowable catch(TAC) to companies building new fishing boats and those constructing fishery product processing factories in Russia. To participate in selection process, the amount equal to 5% of investment is required to be paid in cash or in the form of bank guarantee.

5. Suggestions

It is considered necessary to participate in marketing events, such as various exhibitions, in Russia.

There is a need to make entry into the Russian market through major marketing events such as the largest biennial shipbuilding exhibition of Russia and CIS(NEVA 2017) held in St. Petersburg.

In NEVA 2017, several domestic companies participated in and promoted excellence of their products in Russian market. NEVA 2017 became larger than in 2015, reflecting the economic recovery in Russia. To advance into the Russian market, various certifications and classification society classification are required, which would need to be checked and familiarized with.