Feature Story Regional Analysis And Implications Of Major Industries In China(Shipbu…

페이지 정보

작성자 최고관리자 댓글 0건 조회 4,923회 작성일 19-12-23 13:13본문

5. The Shipbuilding Industry’s Korea-China Exchange Trends by Region

(1) The Shipbuilding Industry’s Korea-China Import and Export Trends by Region

China’s shipbuilding industry’s exports to Korea are comparatively small, accounting for only 2 – 3% of total exports. However, as shipping companies’ practice ‘Flag of Convenience (FOC)’, China’s ship exports are to Hong Kong (27.5%), Singapore (16%), Marshall Islands (11.6%, Malta (6.2%) and Liberia (5.4%). Therefore, it can be said that ships imported from China into Korea, holding Korean registration are limited. Ship imports from China into Korea multiplied following the Global Financial Crisis (GFC) due to Korean shipbuilders constructing and importing ships from China for its lower costs. Also, recently, Korean medium-sized shipyards have begun to collapse from increased imports of low-cost bulk carriers and small tankers. Upon examining by region, imports from Jiangsu Province, a

major manufacturer of bulk carriers and tankers constructed by New Times Shipbuilding and Yangzijiang Shipbuilding Group, totalled $660 and $670 million in 2011 and 2012, respectively. Imports from Shandong Province, home to Samsung Heavy Industries’ production base and Samjin Shipbuilding’s Chinese-based corporate body, totalled $500 million in 2011. Furthermore, imports from Zhejiang Province have also been consistent as COSCO Zhoushan and Korean shipping companies have ship repairers there. Although China’s trade difference in ship imports from Korea is significant, it has maintained a 10 – 20% difference since 2009. Upon examining China’s major import markets in 2017, the following was observed: Japan (20.6%), South Korea (19.2%), Brazil (16.7%), and Singapore (4.7%). Also, upon examining China’s regional imports from Korea, imports were mainly from regions with the presence of major shipping companies such as Tianjin, Shanghai, and Jiangsu. Upon examining marine exports by region, most exports were made from Sichuan Province and Chongqing.

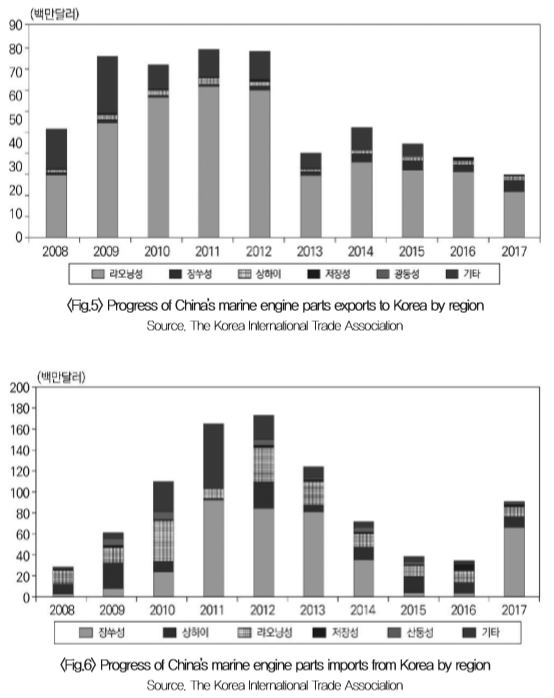

Although in 2010 and 2013, Liaoning Province and Shanxi Province recorded large export figures, it is presumed that most exports made by major engine manufacturers such as STX Dalian Group. Upon excluding the 2 – 3 years of sudden growth, it can be observed that small engines are being exported as marine engines; however, the scale of exports is increasing incrementally. On the other hand, China is importing Korean engines on a large scale, but these figures are much lesser than the shipbuilding industry’s pre-2013 recession figures. Imports are centred-around areas with a well-developed shipbuilding industry such as in Jiangsu and Zhejiang. Following the STX Group’s bankruptcy, imports into Liaoning has decreased dramatically. Upon examining China’s regional marine engine parts imports and exports to-and-from Korea, most exports origi

nate from Liaoning and imports are made from Jiangsu, Shanghai, and Liaoning. Before and after the GFC, marine engine parts imports and exports were made from Anhui Province’s shipbuilding complex by manufacturers such as Wuhu Shipyard. However, recently, there has been no record of any trades being made. Regarding marine propellers, upon excluding the sporadic exports originating from Jiangsu and Shanghai, exports are seldom made from other regions. Concerning imports, during STX Dalian’s active years, mass imports were made into Liaoning. Considerable imports were also made into Jiangsu up until 2013 but have now declined significantly. Also, excluding the anchor parts imports made by STX Dalian from 2012 to 2013 into Liaoning, there are almost no imports made from Korea – imports are limited to $1000 in 2016 and $7000 in 2017. On the other hand, exports to Korea, despite the industry’s recession, was consistent, especially from Jiangsu and Shanghai.

Previously, the Ballast Water Management System (BWMS) contributed significantly to China’s trade deficit with Korea. However, recently, this deficit has decreased substantially. Exports to Korea used to be made from Shandong, Jiangsu, and Shanghai, but beginning 2017, most exports were made from Jiangsu only. This is because U.S. Coast Guard (USCG)-certified, SUNRUI and Headway Technology, which is receiving approval, are situated in the region. Korean companies, Samsung Heavy Industry and TECHCROSS have received USCG certification, and PANASIA and NK BMS Shipping & Marine are in the process of obtaining certification. As Korean companies have

been able to develop products and receive certification ahead of Chinese companies, regions with major shipyards such as Jiangsu, Zhejiang, Shanghai, and Guangdong Province import products from Korea. However, following a recession in the new shipbuilding market, Chinese companies have been able to capitalize on the opportunity to develop products and gain accreditation, leading to the fall in imports from Korea. Derrick and Cranes used to be imported from Korea on a small scale into regions such as Shangdong, Liaoning, and Shanghai. However, even that has declined. This is presumed to be a consequence of the fall in shipyard production and general economic difficulty among Korean marine crane manufacturers.

From 2011, China’s exports showed signs of stability, especially around regions with major machinery and marine equipment production facilities such as in Shanghai, Shandong, and Jiangsu.

(2) Major investment trends into the shipbuilding industry by region

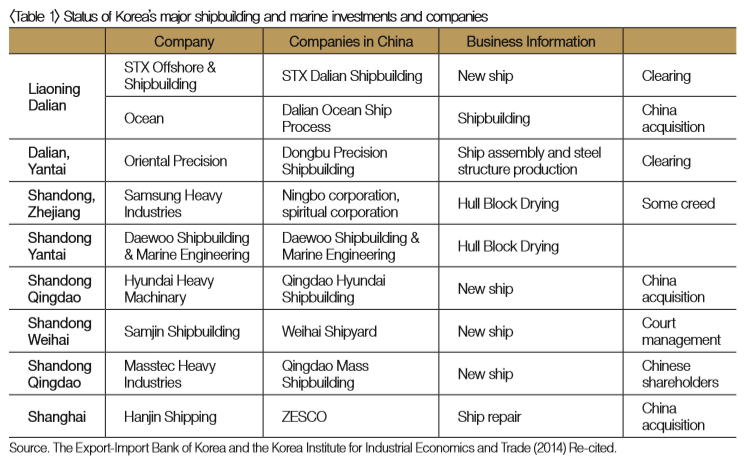

Significant investment’s into Korea’s shipbuilding industry increased until 2008 but shrunk drastically following the GFC. Recent investments into Korea’s shipyards and equipment manufacturers have been meagre. Before the GFC, the shipbuilding industry was going through an exceptional boom period to the point in which Korea’s shipbuilding equipment manufacturers could not keep up with the demand for ship blocks. As a result, major Korean equipment manufacturers entered the Chinese market for its geographic proximity, low labour costs and the Chinese government’s active investment policy. In 2006, 100% of Korea’s shipbuilding industry investments was to China. In 1995, Samsung Heavy Industries began operating its block production facility in Ningbo, Zhejiang with production capacity rising from initial levels of 120,000 tons to 200,000 tons at its peak. In March 2006, work on another block production facility in Rongcheng, Shandong started and was completed towards the end of 2008 with an annual production capacity of 500,000 tons. In September 2005, Daewoo Shipbuilding and Marine began constructing its block production facility in Yantai, Shandong with a production capacity of 300,000 tons annually. The facility began operating at the end of 2007. Hyundai Heavy Industries did not establish a production facility but did found a holding company in June 2006 in Shanghai.

STX Shipbuilding began operating in March 2007 in Dalian, Liaoning’s shipbuilding and marine production complex. STX Shipbuilding’s yard in Korea is relatively small, limiting the size of ship construction, but by establishing a large-scale yard in China, the company was able to differentiate its market entry compared to other shipbuilders. Although not a shipbuilder, in March 2007, Hanjin Shipping began operating a ship repair yard at Qushan Island with its Chinese partners, Sunhwa Shipping, in a 50:50 joint venture. Hyundai Corporation entered the Chinese market through a joint venture investment in 2005. However, in 2010, Hyundai Heavy Industries’ Qingdao shipyard, except for its block production facility which is owned by Samsung Heavy Industries and Daewoo Shipbuilding, was mostly liquidated or bought-out by Chinese companies. Upon examining investments to China, it is observed that significant investments took place in 2007 through major Korean companies investing in Shandong and STX Shipbuilding’s investments in Liaoning. In the case of Jiangxi Province, although no shipbuilder carried-out any direct investments, the province recorded large-scale investments in 2008. This is presumed to be due to statistical error. Following the GFC, investments to China declined significantly, and after STX Shipbuilding began to experience hardship, continuous investments were only observed in Samsung Heavy Industries’ and Daewoo Shipbuilding and Marine’s home province of Shandong.

Concerning shipbuilding equipment (shipbuilding equipment parts), investments were concentrated in regions with major Chinese and Korean shipyards such as Shandong, Liaoning, and Jiangxi. This is especially so for Liaoning as STX Shipbuilding carried-out continuous investments from 2007 to 2012. However, excluding Liaoning, is appropriate to say that effectively no investments were carried out in the steel ship construction industry and the post-GFC shipbuilding industry in China. Liaoning was only able to experience continued investments post-GFC as STX Shipbuilding was running an integrated production complex with not only a shipyard, but also with a block production facility and ship parts factory. Aside from STX’s shipyard and block plant, which was completed in the latter half of 2018, the group also had invested in a primary materials factory for casting, forging, and producing steel pipes. STX Group’s shipbuilding equipment-related manufacturers such as STX Dalian Metal Co., STX Dalian Offshore Co., STX Dalian Engine Co., STX Dalian Heavy Industries Co., STX Dalian Heavy Equipment Co., all entered together. Furthermore, STX had entered into a partnership with a cluster of suppliers next to the Group’s complex to supply the Group with necessary marine parts, paint, and machinery. According to the Export-Import Bank of Korea, major Korean equipment companies had invested in Dalian and its surrounding areas.

However, post-GFC, STX Dalian’s losses worsened and eventually ceased operation in 2013. In 2014, it applied for revival of its business, and following its bankruptcy in March 2015, investments to Liaoning’s shipbuilding equipment industry became almost non-existent. Arising from STX Dalian’s bankruptcy, receivables and investments of 67 shipbuilding equipment manufacturers in Busan and Gyeongnam Province, South Korea were negatively affected. Furthermore, STX Dalian’s failure to dispose of assets after its bankruptcy caused significant investment losses.

As major Chinese shipbuilders and shipbuilding equipment manufacturers are still undergoing restructuring, Korean shipbuilders and shipbuilding equipment manufacturers have shown signs of momentary cease in overseas investments and market entry. Shipbuilders have experienced that entering the Chinese market based on low labour costs could prove costly and that compared to productivity, labour costs have risen considerably. As a result, further investments to China will be limited. It can also be expected that additional investments to China by shipbuilding equipment manufacturers will be delayed. Concerning multi-use ship building equipment’s, as China has acquired relative competitiveness, it is presumed that they no longer require cooperation with Korean companies. Also, key parts designated by ship owners are mostly traded as systems (engines, pumps, BWMS, scrubbers, etc.). As a result, investments to China will momentarily cease given the difficulty for re-market entry by Korean companies which have previously experienced heavy losses in China, and due to complexity in protecting intellectual property and supporting is business in Korea.

6. Characteristics of the shipbuilding industry’s major regions

The shipbuilding industry’s regions of interest either have fast-growing markets or are regions that are relatively large and able to maintain stability and safety. However, as finished products are consumed domestically, there is greater emphasis on equipment. Meaning, as finished products such as ships and offshore plants are mostly obtained by domestic companies, the regions from which ships and offshore plants are constructed are unimportant. On the other hand, areas with existing shipbuilders has demand for equipment, which also have the potential to become markets for Korean manufacturers. Regions along the Yangtze River such as Jiangsu and Shanghai; areas such as Liaoning to

the North and Zhejiang and Guangdong to the South are regions with a high concentration of shipyards and also high production output of finished products will have high demand for manufacturing equipment. Jiangsu is both China’s most active region for ship production with private shipbuilders such as Yangtze River Shipbuilding and Shinsaegae Shipbuilding and the region with the most of CSSC’s subsidiary equipment manufacturers. China’s stateowned shipbuilder, CSIC has its head office in Shanghai. And following in CSIC’s footsteps, Kangnam Shipbuilding, Hudong Zhonghua Shipbuilding and Shanghai Shipbuilding have all moved to and are operating in Pudong, Shanghai. Waigaoqiao Shipbuilding since its expansion in the early 2000s has maintained its presence in the same area. CSIC also has an office in Dalian, Liaoning. Dalian Shipbuilding, COSCO Dalian and Dalian COSCO KHI Ship Engineering are also nearby. Zhejiang, to the South of Shanghai, has state-owned shipbuilders such as Jinhai Heavy Industries, COSCO Zhoushan Shipyard as well as other private builders. Most repair and maintenance yards are concentrated in Zhoushan. Guangdong, one of China’s three most significant shipbuilding clusters, is on the Pearl River Basin, where many companies are subsidiaries of CSSC. Guangdong holds the Guangzhou International Boat Show and the COSCO-Guangzhou Boat Show.

7. Korea’s Industry Response and Market Entry Strategy

(1) Korea’s Industry Response by Region

Until recently, China has promoted industrial structure advancement by proposing policy stance for information convergence, technology convergence with the manufacturing industry, advanced ‘smartization’, and eco-friendliness for not only the core industries but also for the shipbuilding industry. China is also making progress towards ‘Smartization’ and eco-friendliness in line with development in Korea. Of course, China’s large shipbuilders do not appear to be able to overtake China as the foundation for building and delivering first-generation smart ships have accumulated since 2010. However, the development of smart ships, autonomous ships, and eco-friendly ships have been pursued based on mid- to long-term policies as it pushes forward with intensity. It is likely that the advancement of China’s shipbuilding and equipment industry will progress to a greater level. In particular, the detailed description of the shipbuilding and marine sectors of ‘Made in China 2025’ is focused on the advancement of various marine systems, the enhancement of related technologies and systems, engineering, the securing of shipboards for cruise ships, the enhancement of the competitiveness of LNG transport and fuel propulsion ships, and various detailed equipment and systems. It focuses on high value-added technologies, such as securing technologies such as integration and intelligence and includes plans to upgrade engineering and systems that are still vulnerable. Yet, weak engineering and system advancement plans are also included. China’s development and promotion plan share many correlations with that of Korea’s.

Furthermore, China’s plan aims to convert shipbuilders’ ships and offshore plants through ‘Smartization’, management system development, and internet and information technologybased methods. Since the development of medium and large cruise ships is included in the core products and target areas. The linkage strategy with the market development incorporating its demand is apparent. In other words, the future policy aimed at China’s shipbuilding and maritime sector is no only smart, autonomous and eco-friendly, but also overlaps with Korea in target products. China’s central government policy is likely to continue steadily and intensively, but also emerge as a threat to Korea.

In response to the advancement of China’s industrial structure by region, Korea’s shipbuilding and marine industry’s response strategy requires pre-emptive technology development to maintain a gap with China. Since China is also deve

oping technologies and products based on the global market, it is necessary to target the core needs of global shipbuilders and energy companies, differentiate core technologies, reduce costs, improve quality, and pre-emptively respond to future trends. Especially in the case of Shanghai and Liaoning, where SOEs are concentrated, the development of smart and eco-convergence technologies can be accomplished by firstly focusing on the technology and quality gap of large and high value-added merchant ships needed to focus on for competitive advantage and profitability. In the case of equipment, it is necessary to target the marine engine parts market, which Korea still has competitive advantages, along with BWMS and scrubber related to strengthening environmental regulations. Meanwhile, Jiangsu Province, which has a large proportion of private companies, is expected to apply eco-friendly and smart convergence technology and develop small- and medium-sized special high value-added ships to target the market’s demand. In the case of equipment, similarly, Korea needs to target the

marine engine and marine engine parts market, in which Korea also has advantages, along with BMWS and Scrubbers. In the case of Guangdong, it is necessary to reduce the cost of general-purpose ships using ‘Smart-Yard’ technology, apply eco-friendly and smart convergence technology, develop small- and medium-sized special high value-added vessels, and respond to the market. At the same time, strategies to cope with technology and quality gap of large, high value-added merchant ships through development of smart, eco-friendly convergence technologies will also be useful. In the case of manufacturing equipment, a similar strategy is also needed by region. In Zhejiang, Korea needs to expand business to marine-related services such as ship repair and renovation, offshore plant after service, design engineering, and shipyard layout consulting based on Korea’s accumulated experience and technical capabilities. At the same time, the market will be active based on cost reduction of general-purpose ships, application of smart and eco-friendly convergence technology, and the develop ment of small- and medium-sized special high value-added ships. In particular, Zhejiang is a region with a large proportion of ship repair and renovations; as a result, the equipment market is expected to be more effective than in other areas.

(2) Korea’s Industry’s Entry Plan by region

In the case of China’s market entry strategy, it is becoming increasingly difficult to enter the Chinese market of finished goods such as ships and offshore plants according to China’s policy direction. However, in the case of the equipment industry, China has a high proportion of construction ship number for general-purpose ships. Therefore, if the appropriate entry strategy is established and processed according to China’s regional market situation, it will be able to achieve its own performance. For example, it seems necessary to have a strategy in which local agencies operate in close demand and actively utilise local humans.

(3) Korea’s industry’s cooperation plan by region

Until recently, Korea differentiated itself through high valueadded products with relative difficulties such as LNG carriers, LPG carriers, ultra-large container ships, drillships, and FPSOs. If China concentrates on general-purpose vessels such as tankers, container ships and bulk carriers, it may be possible to divide the product between the two countries. However, due to a global market downturn, not only has overall demand declined, but also China has begun to enter Korea’s flagship product areas. As such, division of labour is unlikely to be established in ships, offshore plants, and specialised equipment such as engines, BWMS, and Scrubbers.

As competition with Korea intensifies, it will be increasingly difficult to cooperate in the fields of finished products and equipment. However, in the short term, Korea needs to strategically respond to the supply and demand of equipment and niche markets by maximising on the opportunity arising from China’s shipbuilding industry’s weak production and self-sufficiency ability. Meanwhile, there is still a possibility that China will strategically approach high value-added vessels, shipbuilding and offshore equipment with demand. In this case, cooperation with China needs to respond carefully without exposing our core technologies, design capabilities and know-how.