Special Report LNG Carrier Value Chain and Competitive Advantage Analysis ③

페이지 정보

작성자 최고관리자 댓글 0건 조회 2,168회 작성일 20-12-15 19:08본문

(4) Innovation

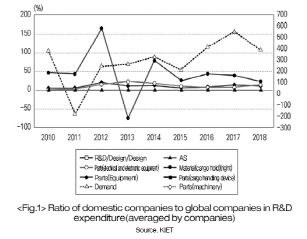

① Proportion of R&D cost by domestic companies to global companies

When examining the proportion of R&D expenses, domestic companies in parts(cargo storage) and A/S sectors cannot be analyzed due to the lack of information on R&D expenses. As for materials(cargo storage), blue-chip companies like POSCO contribute to the high ratio of R&D expenses of domestic companies to global companies. In the demand sector, energy companies and Hyundai Motor Group contribute to the relatively high number of R&D. Besides these companies, domestic primary shipping companies do not have any notably significant amount of R&D expenses and therefore comparison analyses do not bear significance. Although Korean shipbuilders have large R&D expenses in design sectors, the scale is smaller than those of global heavy industries with considerable scale such as Kawasaki Heavy Industries and Mitsubishi Heavy Industries. In parallel to this, in terms of the ratio of R&D cost to sales, domestic companies show significantly lower numbers than global companies. This is the same even when we look at the top 30%. Although information on R&D expenses are limited, most companies show similar patterns and themes overall. However, in the case of parts(decorative products), as in other sectors, the proportion of the top 30% is higher than that of global companies. As mentioned above, when looking at R&D expenditure compared to sales in primary divisions, major domestic shipbuilders account for 0.2~0.7%, while global companies are very high at around 2% for design. Parts(mechanical devices) and parts(electrical and electronic equipment) are also very low for domestic companies at less than 1%, whereas global companies are at 3-4%.

② Supply competitiveness of domestic companies compared to global companies through measuring innovation capabilities

In the construction stage of LNG carriers, the supply competitiveness of materials and parts is as follows. When it came to be having a diverse product portfolio, domestic companies have higher competitive in cargo hold materials compared to global companies. This is due to Korean companies with diverse portfolios such as POSCO, Korea Carbon, and Dongsung Finetech. As for paint materials, whereas domestic companies focus on paints, global companies possess various products such as coatings. As a result, it is analyzed that domestic companies have a slightly lower portfolio than global companies. In parts(cargo handling equipment), it is observed that the portfolio of global companies was better structured than that of domestic companies, but the difference was not significant. Such case is due to the specialization that foreign companies have in manufacturing valves and pumps for LNG carrier cargo handling equipment. Naturally, companies that possess a lot of equipment such as Alfa Laval, Siemens, Atlas Copco, and KSB, have notably high portfolios. In parallel, domestic companies such as LHE, S&S Valve, Panasia, Hy-Lok Korea, and Halla IMS have portfolios equal to or greater than those of global companies. In parts(machinery), domestic companies were analyzed to have better portfolios compared to those of global companies due to the presence of major engine companies such as Hyundai Heavy Industries, HSD Engine, and STX Engine. Another primary reason for this outcome is because there are many global companies that solely specialize in producing specific parts and items. The analysis of parts(electrical and electronic equipment) showed no significant difference in portfolio holdings between global and domestic companies, although compared to some parts slightly lower. This is because there are many companies specializing in electric and electronic equipment parts. As for parts (decoration), global companies, which possess a variety of items and are competitive, have higher holdings than domestic companies focus on specific parts and therefore hold less portfolios.

The investment areas for major materials and parts for LNG carriers for domestic companies that produce cargo hold materials for the next five years were 81% in Korea, 6% in developed countries, and 13% in developing countries. Paint materials were 58% in Korea, 24% in developed countries, and 18% in developing countries. It is important to note that the result for this analysis was affected by a select number of companies due the lack of overall companies in the market. For major parts (cargo handling equipment, the domestic companies' investment areas for the next five years were 87% in Korea, 4% in developed countries, and 9% in developing countries, and the trend was similar to that of cargo hold materials. For Parts(mechanical equipment), the distribution is as follows: domestic 71%, developed countries 11%, developing countries 18%. Parts(electrical and electronic equipment) seemed to be domestic 90%, developed countries 6%, developing countries 4%, and for parts(design), it was: domestic 78%, 3% in developed countries, and 19% in developing countries. Whereas companies that produce parts for LNG carriers mainly focus on the domestic market as their primary operation sites since they cater to domestic customers, companies that manufacture equipment that can be used for other types of ships beyond LNG carriers seem to aiming to enter developing countries due to the weakened general-purpose ship market domestically.

It is projected that domestic countries will not largely invest in upstream or downstream industries over the next five years. For material(cargo storage), 74% of budgets are used for existing operations and upstream and downstream industries comprise 13%. In parts (machinery), it was found that 74% was allocated for existing company operations, 15% in downstream industries, and 11% for upstream industries. Similarly, parts(electrical and electronic equipment) accounted for 76% for existing operations, 19% to downstream industries, and 5% to upstream industries, and parts(equipment)’s breakdown was 76%, 14%, 8% for the corresponding order. As for paint materials, 62% of the budget is dedicated to existing operations, and are planning to invest 21% and 17% of their budget in upstream and downstream industries, respectively. Domestic companies that comprise the parts(cargo handling equipment) industry have a relatively higher account: 63% for main business, 4% for upstream, and 33% for downstream industries. Such movement can be interpreted as a move to establish stabler markets or expand to a more systemized equipment area.

③ Innovativeness of domestic companies compared to global companies

The technological capacities of domestic companies that produce materials and parts for LNG carriers are as follows. For cargo hold materials, domestic companies compete equally with global companies, and paint materials are also equal because both domestic and JV companies are all producing them. Parts(cargo handling equipment) comprise 80% of overall global companies. Thanks to large, globally competitive companies like Hyundai Heavy Industries, HSD Engine, STX Engine, Donghwa, and Kanglim, domestic producers of parts(machinery) have 90% higher average than global companies. Parts(electrical and electronic equipment) record to be on 85%, but predominantly for large companies such as LS Cable & System and Hyundai Electric, and excellent SMEs. Parts(equipment) are at around 90% for domestic companies, which means they have high competitiveness in major accessories globally.

In terms of human capital, domestic companies are on equal grounds with global companies in cargo hold materials and paint materials. In terms of parts(cargo handling equipment), it was 70% lower than that of global companies. Parts(machinery) are at 85% of global companies, which is relatively and notably high. Typically, technological competitiveness and human capital competitiveness were similar between the two categories. However, it was found that domestic companies have lower human capital competitiveness in cargo handling equipment parts and machinery parts, despite its competitiveness on the technological level.

④ Competitiveness of Patents Between Domestic and Global Companies

When looking at the patents related to LNG carriers over the past 10 years, Japan has 42.6%, Korea 20.4%, Germany 13.6%, US 11.5%, Netherlands 4.6%, and Sweden 3.1%, which 95.9% is collectively comprised by the top six countries. The terms of registered case are as follows: Japan(45.4%), Korea(23.7%), the United States(10.8%), Germany(9.8%), the Netherlands(3.9%), and Sweden(2.3%). When only considering the 10% of countries, four countries Japan, Korea, the United States, and Germany are in competition.

Compared globally, Korean companies have a large number of applications and registrations, whereas the citation index and market security index are relatively low. On the other hand, the Netherlands does not have many applications or registrations while its citation index and market security index are very high. Similarly, in Japan, the citation index and market security index are closer to the world average.

Therefore, Korea ranks high globally for the quantity of patents, but lower ends on the level of impact.

(5) Law Institution and Infrastructure

- The legal, institutional and industrial infrastructures of Korea

In relation to global standings, Korea's legal, institutional, and infrastructure competitiveness are as follows. In materials(cargo tanks), Korea has globally competitive levels in law, systems and infrastructure. However, the difficulty of securing supplies of Invar and birch domestically and the likely relocation of insulation material sectors to countries with lower production cost poses as challenges. Although both marketability and new product development of paint materials are sufficient, environmental regulations limit production and utilization. Therefore, systems and infrastructure only reach the 80-90% capacity compared to other developed countries. In parts(cargo handling equipment), major companies recognize the environmental and safety requirements related to LNG testing facilities, as well as the difficulty of getting foundry manufacturing plants certification; therefore, law, system, and infrastructure are evaluated at 70% level compared to other developed countries. In addition, because the related parts are affected by the application performance and the shipowner's trust or preference, performance and trust must be built domestically. Except for a select number of systems, large domestic companies secure the marked for parts(mechanical equipment). Subsequently, the legal, institutional, and industrial infrastructure were identified to be globally competitive. On the other hand, parts(electrical and electronic equipment) were evaluated at 70-80% compared globally. This is due to the low-profile of domestic companies, lack of development infrastructure, and performance, which results from undeveloped infrastructures and the absence of communication equipment and fire suppression devices. Among the parts(equipment), casting product, licenses and permits thwart expansion of factories. In addition, the labor-intensive industry on a domestic level place the legal, institutional and industrial infrastructure to 80 to 90% compared to the global producers. LNG handling parts and navigation communication equipment are weak points of domestic production. They were found to lack technical basis and demonstration support. Parts such as LNG handling facilities, paints, fire suppression devices related to safety and environment or labor costs had lower competition.

4. Future value chain structure and change analysis

(1) Internalization of value chain through localizing equipment

The three major domestic companies(Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, and Samsung Heavy Industries) are key groups in the LNG carrier value chain structure. They are actively supporting the localization of LNG carrier equipment because of the high cost ratio and high localization effect. As a result, these companies are highly cooperating with equipment companies. They are motivated by the possibility of increasing the delivery-based yield through reducing the procurement period, which will easily save cost on material and parts during the production stage. This will be easily attained through localizing their equipment.

According to the recent surveys on ship loading standards, the rate of localization of equipment by ship shows the following: container ships are the highest at 80%, followed by oil tankers such as VLCC at about 74%, and LNG carriers at about 52%. The localization rate of conventional equipment is estimated to be about 85-90% for general-purpose ships such as oil tankers and container ships, and about 60-65% for LNG carriers.

The reason behind the varying standard localization rate in comparison with actual localization rate is due to the demand for foreign equipment by the shipowners. Even if there are localized items, it is difficult to mount them on a ship if the shipowners are not trusting. As a result, even if a large number of equipment is localized, in order to be mounted on a ship, it must be track-recorded, which may be more appealing to the shipowner to trust.

Domestic companies are leading the global market for LNG carriers, and shipowners are highly confident with the quality of ships and equipment. Therefore, if more domestic parts are being loaded on ships, there are more reasons for domestication. In other words, the internalization of the value chain and domestic procurement could lead to employment expansion and domestic production.

In order for such successful outcomes to expand, shipbuilders and equipment companies must cooperate and develop together. For domestic products to upgrade above and beyond foreign equipment, domestic equipment companies must cooperate by integrating their know-hows that accumulated while receiving the actual delivery from the shipyard and loading it on the ship. The current delivery necessitates joint development with equipment companies and product improvement.

Once domestic products replace foreign supplies, many problems such as procurement delay, a primary difficulty for shipyards, can be solved. Furthermore, it is projected that there will be a decrease in procurement cost due to the reduction of logistics cost. In fact, there are existing cases localization of equipment led to real-life cost reduction, which is espoused by shipbuilders who welcome and actively support the localization of equipment.

(2) Value chain enhancements

Value chain enhancement for LNG carriers are visible in the strengthening of R&D by shipbuilders. Generally, in the manufacturing industry, the value-added trajectory for each value chain in the is a smile curve. On the other hand, the added value is relatively higher in R&D and engineering in the shipbuilding industry(particularly in LNG carriers), and relatively low in operation and repair. Due to the fact that operating margin fluctuates significantly for operating divisions, it is difficult to compare rates at a specific point in time, but it is estimated to be lower than the added value of the pre-manufacturing R&D and engineering divisions. Large shipbuilders building LNG carriers are expanding their LNG-related products such as LNG fuel promotion. This movement is in accordance with the international maritime organization's reinforced environmental regulations on ship emissions, which leads to a stronger R&D sector.

Meanwhile, the recent surge of installing core technologies of the 4th industrial revolution to ships is visible in multiple ways. The smart market maintenance market is judged as a promising area, and many companies employ strategies to expand their value chains to the A/S and retrofit markets.

(3) Expansion of the value chain

① Expansion of the value chain of LNG carriers

Large shipbuilders have operated business under a model that that integrates R&D, design and engineering, core equipment, and LNG carrier construction for value chains of LNG carriers. Due to this, shipping, A/S, and retrofit were excluded. In the past, operations were included only in the following scenarios: STX Offshore & Shipbuilding included STX Pan Ocean within the group, Hyundai Heavy Industries and Hyundai Merchant Marine belonged to the Hyundai Group, and Hanjin Heavy Industries and Hanjin Shipping included within the Hanjin Group. Basically, these were cases in which operations were included in the group's business. However, operations and A/S are excluded. However, since 2017, certain shipbuilding companies are including the A/S categories as a part of their business models.

In particular, the prospect of applying core technologies that result from the 4th industrial revolution shifts A/S to a potential business strategy. The and commercialization of smart autonomous ships will be promoted by predictive diagnosis, a product of the technologies that were developed with the advent of the 4th industrial revolution.

Smart autonomous ships(including LNG carriers) can significantly reduce operating costs through reducing and eliminating the number of passengers on board. This leads to a reduction in shipping costs for shippers and therefore develops high demand, which is a key element in commercialization.

One of the key functions and conditions of smart autonomous ships is to diagnose and predict ship failures in advance, which directly connects to the ship's A/S business. This will lead to an expansion of the value chain as it allows the ship to self-monitor necessary and will perform A/S and retrofit.

Primary consumers that are shipping companies are demanding A/S and retrofit capabilities. In addition, they expect new construction, and providing full-cycle services for ships and offshore plants. Such case is parallel to the commercialization strategy of full-cycle services promoted by large domestic shipbuilders.

Considering that the core technologies that germinated from the 4th industrial revolution are will be grafted into the shipbuilding and offshore industries in the near future, the impact and practical benefits these changes will bring to the shipbuilding industry are clear. Such transition necessities proper responses. Large domestic companies must transition to SSP(Smart Ocean Solution Provider), and some places are preparing for it. In other words, large domestic shipbuilders are in the process of building smart yards and developing smart autonomous ships for efficient construction processes. In addition, they are preparing to provide a total solution that integrates maintenance services that will occur while operating.

② Value chain expansion to LNG-related products

LNG operated vessels are increasing due to active regulations led by the International Maritime Organization to combat emissions such as CO2, SOx, and NOx. LNG is estimated to have the effect of reducing CO2 by 23%, SOx by 99%, and NOx by 80% compared to conventional ship fuels. Effectively from January 2020, most of the CO2 and NOx emission in addition to the new SOx 0.5% emission standards must be met. Domestic LNG carrier builders is recognized for their competitive qualities not only for LNG carriers but also for LNG fueled ships. This is because LNG carriers use vaporized LNG as fuel for ships, so they can be evaluated as LNG-fueled LNG carriers.

Since the global ship market in the future must transition to eco-friendly fuels in accordance with global environmental regulations, general-purpose ships such as bulk carriers, oil tankers, and container ships are target ships for LNG fuels. This even includes bulk carriers, an industry that was shunned by domestic producers because of their poor price competitiveness. As they are also supposed to be converted to use LNG-fueled bulk carriers, they are projected to be new targets.

In addition, the expansion from LNG-RV(Re-gasification Vessel) to LNG-FSRU(Floating Storage Regasification Unit) and LNG-FPSO(Floating Production Storage and Offloading) have already progressed. The expansion of the value chain to such LNG-related products is progressing not only in the shipbuilding sector, but also in the equipment and engineering sectors.

5. Value chain enhancement policy evaluation

(1) Diversifying support policies from shipbuilding to localization of equipment

The early policies of the domestic shipbuilding industry(1960-1980) concentrated on manufacturing and shipbuilding, which was evaluated as having low added value. Such is visible in the expansion of shipyard facilities to build of medium and large ships, assistance in building the difference in ship prices to facilitate construction, reduction of tariffs on imported equipment, support for large-scale facility expansion, technical support, in addition to various financial support and construction volume through planned shipbuilding.

Further along, the domestic development of shipbuilding equipment progressed through localization policies that promoted machinery and parts in 1986. Demonstration and commercialization were also supported so that mutual purchases were possible in large shipyards. In other words, support policies that focused on shipbuilding (manufacturing) spread to the equipment sector, which is a related rear industry. Through this, the proportion of domestic equipment installed on ships built by domestic shipbuilders began to increase substantially and the added value remaining in Korea also increased.

(2) R&D support: advancing industrial structure through technological innovation

From the 1990s, industry-specific support characteristics were largely abolished. This was preceded by more autonomy proceeded, which accompanied technological innovation, which was seen as a major catalyst for the advancement of industrial structure. This also led to increased support for R&D. Industrial structure advancement policy was broadly pursued to promote R&D and targeted technological innovation. Such perspective came from forming dynamic comparative advantage based on market principles.

Particularly, as post-2000 domestic shipping industry took the No.1 in the world, the need for R&D increased accordingly. As a leader, Korea moved beyond simply imitating and improving the products and technologies of advanced countries. Accordingly, the government was put in a position to develop new technologies and products that differentiate the market. As a result, the competitiveness in the R&D stage of the value chain as well as shipbuilding and equipment production significantly improved.

(3) Enhancing vitality for value chain, response to downturn in demand

The measures to improve the vitality of the shipbuilding industry in 2018 focused on overcoming the difficulties and competitiveness of each value chain. The global downturn and decrease in that began during the financial crisis of 2008 led to subsequent offshore plant markets and sharp decline in oil prices in the second half of 2014. During such times, maintenance and reinforcement were prioritized rather than building ships. Specifically, the provision of work in the shipbuilding and equipment sectors through domestic demand creation, guarantees and financial support, and ongoing eco-friendly and smart R&D initiatives are primary focuses.

The global decline in demand circa 2010 was a key factor in the difficulties and problems of each sector. This led to the necessary measures that respond to the eco-friendly ship market led by measures introduced by the International Maritime Organization. Such measures are continually being strengthened and expected to contribute to the advancement of the value chain for each sector of LNG carriers. Particularly, it includes the introduction of smart shipyards aimed at enhancing the mid- to long-term competitiveness of small and medium-sized shipbuilders and equipment, support for expanding orders by establishing overseas bases, strengthening design capabilities of small and medium-sized shipbuilders, and developing autonomous ships.

On the other hand, the supply of eco-friendly ships and facilities are expanded in order to meet international environmental regulations for ships operating. As a result, the supply of eco-friendly ships and facilities are expanded, and eco-friendly retrofits of existing ships are supported. In order to establish the basis for commercialization of localized equipment development of LNG, hydrogen, and electricity propulsion ships, introduction of demonstration ships, and installation of domestic equipment on domestic ships are also actively promoted. LNG fuel propulsion, electricity and hydrogen propulsion ship equipment are installed through the public ordering of eco-friendly ships. LNG bunkering ship infrastructure, an infrastructure for LNG fuel propulsion ships, is also expanded to strengthen eco-friendly competitiveness in the shipping sector.

(4) Strengthen competitiveness of materials, parts and equipment

Although this policy is not applied the shipbuilding industry only, the strengthening of policies that ensure competitiveness in materials, parts and equipment lead to the localization of equipment for LNG carriers, which is still in the 50% range based on loading standards, is expected to gain momentum.

The ways to strengthen the competitiveness of materials, parts and equipment are focused on investing on large-scale R&D resources in core items, introducing bold and innovative R&D methods to rapidly accumulate technology, and importing, domestic substitution, and expanding inventory for items. Securing the early supply stability and working together should be prioritized. In addition, licensing, working hours, etc. that are needed to seek diversification of technology acquisition pose as a challenge to various government ministries. Revitalization of investment attraction, introduction of overseas technology, and M&A, and inevitable demand for rapid production at industrial sites need to be resolved quickly.

Among the equipment mounted on LNG carriers, a number of items depend almost entirely on foreign countries. Assuming the efficiency necessary to localize and supply domestically, a proper policy must be placed to strengthen the competitive of materials, parts and equipment. This strengthening of competitiveness in the materials, parts and equipment sectors is expected to strengthen the competitiveness of the value chain sector and make it possible to retain the added value that was leaked through overseas procurement in Korea.

6. Sub-conclusion

The construction of medium and large-sized(12.5K-class) LNG carriers in the global market began in 1975, and the first time we built the LNG carrier was June 1994, when 12.5K-class national ships were built. Domestically, LNG carrier were built around 1986, when LNG was first imported into Korea. Subsequently, the preparation of national flagships began, and the first ship was ordered in 1992. Since then, as the construction of the second national flagship proceeded in 1995, experience in design and construction was accumulated, and in August 1999, two 13.8K-class ships ordered from Nigeria's BGT led to the achievement of the first overseas orders. As LNG demand has gradually increased, the number of orders has since been increasingly except during financial crisis.

In terms of the value chain, first building experience and technology development were both foundations for the foundation of high-level technology and quality from R&D to engineering, localization of equipment, and construction of LNG carriers through competition and cooperation with three large companies. The results of this exclusive global competitiveness for LNG carriers are visible by leading stance of domestic producers.

Although China was expected to become a rival country due to its national policy promotion, but it is evaluated that there is still a considerable gap despite its efforts that started in 2004. The demand for LNG carriers and LNG fueled ships appears to be notably bright due to the increased consumption of LNG as an eco-friendly energy and strengthening environmental regulations of the International Maritime Organization for ships. Three domestic companies are highly regarded as top producers of LNG carriers and their markets are fortuitous.

However, the inspection of the value chain of domestic LNG carriers signal to some weak points, which necessities strategic pursuits that respond to each sector. In the case of equipment and materials, the localization rate is the lowest among merchant ships, so active efforts to develop domestically produced and connect demand are required. During the ordering stage, mounting domestic equipment poses as a challenge because the equipment options of shipowners. This may best address through the joint marketing efforts and higher qualities by equipment producers and ship producers. Of course, machinery equipment and electrical and electronic equipment equipment are highly preferred by foreign suppliers such as ABB, Siemens, and Mitsubishi Heavy Industry. As a result, domestic development may be thwarted. However, in the case of other items, concerns over delays and the price competitiveness of domestic suppliers pose appealing to some buyers. Therefore, the ideal strategy must focus on strengthening the competitiveness of LNG carriers and enhancing an entire value chain stage through supplementing the weaknesses such as low localization rate of equipment and materials in the value chain.

During the localization process of cargo hold, there was a problem occurred on the first ship with a Korean cargo. As a response, there must be a national effort that will resolve the issue through swift and formulated response. This is important to ensure that the overall image of Korean shipbuilders will not be negatively affected. Once cargo hold, a key equipment for LNG carriers, is successfully localized and commercialized, the LNG carrier vessels will be even more competitive fields for domestic producers. Localization of equipment enables procurement and cost reduction which is highly effective for shipbuilders. Even if domestic equipment cannot be used entirely, the price of money that solely goes to foreign companies can be reduced.

Meanwhile, there is a high possibility that the demand for LNG fuel-promoting ships will expand due to the environmental regulations reinforced by International Maritime Organization. As a result, active efforts of expanding the value chain to LNG-related products are also necessary. Since using LNG vaporized in the cargo hold as fuel is highly efficient, a ship is technically equipped with the LNG fuel propulsion function. Based on this presumption, the eco-friendly LNG fuel promotion market may will expand to the entire general-purpose ship market based on LNG carriers. In other words, it is expected that the domestic general-purpose ship market that has surrendered the market to China due to its inferior cost competitiveness will be able to revive through eco-friendly LNG fuel promotion solutions.

- 이전글The changing face of fuelst 20.12.15

- 다음글Emerson’s New Laser Welder Enhances Manufacturing Capabilities 20.11.17