Special Report LNG Carrier Value Chain and Competitive Advantage Analysis ②

페이지 정보

작성자 최고관리자 댓글 0건 조회 4,391회 작성일 20-11-17 16:41본문

2. Value Chain Structure Analysis

(1) Classification of Main Equipment for LNG Carrier

Typically, the primary apparatuses that comprise shipping are cargo hold, cargo handling device, mechanical equipment, electronic equipment, and fittings. This study focuses on equipment that are specialized for LNG carriers. Cargo handling devices are made specifically to treat LNG carriers, and therefore much more specialized than equipment for regular merchant vessels. In fact, a select number of core electrical and electronic equipment are mounted to fulfill specialized functions that are unique to LNG carriers. Mechanical equipment includes components such as engine to propel the ship, generator to produce electrical energy, and heat exchanger. Multiple systems that are actively utilizing the gas that produced during vaporization are also mounted in LNG cargo hold. Fittings are used not only to equip LNG carriers but also various other regular vessels.

(2) Corporations that Supply Core LNG Carrier Equipment

For Cargo hold, securing a select number of alloy steel, insulator, and surrounding mechanical components are reliant on importation. Posco, Finetec, Hankuk Carbon, Unitech, and SJM are domestic Korean corporations and NSSC, UACJ, (Metsä Wood), and SFZ are foreign corporations that produce these apparatuses.

Cargo hold and insulator are manufactured after securing necessary materials that are highly specialized. As a result, material is a pivotal component of the overall discussion and companies that source the material are a part of the analysis.

Core equipment and parts to build cargo handling devices are also often imported. Specifically, the primary pump is solely imported from abroad from companies Shinko and Ebara. Additional primary manufacturers for cargo equipment that are foreign are Alfa Labal, AtlasCopco, Cyrostar, Kongsberg, Nakakita, Fukui Seisakusho. Seah Steel, Dongwha, Kang Lim, Finetech, Sunbo Industries, Pkvalve, HanlaIMS are Korean domestic suppliers.

It is postulated that while primary systems such main and auxiliary engines are produced domestically ever since the original technologies were licensed, there is a great reliance on importation of pumps and electric propulsion systems. Hyundai Heavy Industries, HSD Engine, STX Engine are the primary producers of engine and Hyundai Electric, Hyosung, DongHwa Entec, and Oriental Precision & Eng are primary corporations that create other miscellaneous machinery. The primary foreign suppliers of pumps and electric propulsion systems are Shinko, Teikoku, ABB, and Siemens.

For Electric and Electrical Equipment, communication and navigation devices are predominantly reliant on European and Japanese corporations. Excluding a select number of few items, Honeywell, Kongsberg, JRC, Furuno, STN, Atlas are all foreign corporations are leading producers of IAS, sailing equipment, and communication equipment. MRC, SNSYS, Hyunjin, LS Cable & System, Hyundai Electric are primary Electric and Electrical Equipment producers in Korea.

Most fittings are produced by domestic producers in Korea. Dusan Heavy Industries & Construction, Flutek, Yoowon, HipressKorea, Lotte Fine Chemical, HiairKorea, Hyundai Elevator, and Oriental Precision & Eng are the leading corporations in the field.

(3) Model Analysis of LNG Carrier Value Chain

① Production Stage

In order to conduct a supply chain analysis of the construction of LNG Carriers, this study gathered information about the corporations that source the necessary material and produce various equipment. Especially in the case for LNG carriers, criteria such as growth analysis, demand stability, supply competitiveness, innovation were selected after gathering data from Kis-value, KED date, DART and foreign DB. These categories were then verified by experts of the corresponding fields and are used to analyze the domestic and foreign producers that manufacture 44 types of subcategories(a1~e9). The categorization of the 44 types and their suppliers are beneficial to identify which types of materials and equipment are heavily reliant on foreign suppliers by assessing the current state of production on a domestic level. Based on this information, the study deduces factors that contribute to the current stagnation of domestic production and identifies different ways to precipitate domestic production of these parts.

② The Research and Development Stage

In the research and development stage, the study focused on corporations that have their own R&D systems such as Hyundai Heavy Industries, DSME, Samsung Heavy Industries, KRISO, DSEC in Korea, Mitsubishi Heavy Industries, Kawasaki Heavy Industries, JMU in Japan, Hudong-Zhonghua Shipbuilding in China, TGE, a gas engineering and R&D corporation in Germany, and GTT, a French corporation with core technology. Because the study solely focuses on LNG carriers, only the three domestic top corporations that are leading in commercialization were selected. In addition, corporations with core technology were analyzed while R&D that are specific to each equipment were not factored into the study.

The R&D facilities of the top three domestic corporations were equal or better(due to newer technologies) than the R&D of corporations from leading nations such as Germany, Sweden, the Netherlands, and Japan.

In terms of Sloshing, a primary facility related to LNG, the expansion rate of sloshing facilities and its new technologies of DSME appear to be on the same level as GTT, which owns the core technology for NG cargo hold.

LNG Carriers are steadily changing since their conception in 1969. The first vessel was steam turbine based, and steady R&D efforts transformed the ship. In 2004, dual fuel engine was introduced. This was followed by tri-fuel engine technology in 2008, which transformed to two-stroke engines such as MEGI, S-DF in 2016.

③ Design and Engineering Stage

Similar institutions and corporations that were mentioned in the section regarding R&D comprise the design and engineering stage. Corporations that have their own design and engineering division are Hyundai Heavy Industries, DSME, Samsung Heavy Industries, Korea Research Institute of Ships & Ocean Engineering, DSEC in Korea, Mitsubishi Heavy Industries, Kawasaki Heavy Industries, JMU in Japan, Hudong-Zhonghua Shipbuilding in China, TGE, the German gas engineering and R&D company, and GTT, a French company with core technology are considered.

④ Sailing Stage

For the sailing stage, instead of analyzing primary consumers that are primarily global shipping companies such as Maran Gas Maritime, Cardiff Marine, Mitsui O.S.K Lines, NYK, Teekay, Quatargas, and Flex LNG, the study analyzes HMM, SK Shipping Co., and Korea Line. Instead of focusing on shipowners that already possess LNG carriers, the study centers around carriers in order to measure the competitiveness of sailing.

⑤ Retrofit and A/S Stage

For the Retrofit and A/S Stage, Keppel and Sembcorp marine shipyards from Singapore, Xinya Shipyard in China, Samgang S&C, Yeosu Ocean in Korea are analyzed. It is postulated that due to the short amount of time of operation, repair equipment is not optimized for mid-to large sized vessels as well as high-value vessels in Korean corporations such as Yeosu Ocean and Samgang. As a result, their competitiveness in the field are relatively low.

3. A Check of Value Chain Level Competitiveness in Comparison to Trade Rival Nations

In Value Chains for LNG carriers, the market for design/planning/construction stages are established based on manufacturers and the volume of contracts that are being awarded to them. The market for related materials, parts, and A/S are in sync with the market for LNG carriers. Due to the outstanding competitiveness and superiority of the Korean domestic market in the design/planning/construction stages in the global market, it is unnecessary to compare it with its competitors around the world. On the other hand, from the demand(for shipping companies) perspective, it is still reliant on global energy shipping. Furthermore, the A/S category, Korea virtually has no base and as a result, a comparison does not bear any notable significance. Despite these facts, in order for an objective comparison, necessarily index analyses were conducted based on statistical data. However, because the design/planning/construction and the related markets and demands(shipping) and A/S(Fixing and remodeling) were discussed in relation to the global value chain of LNG carriers and markets, they were excluded from this chapter. In addendum, however, the study includes a qualitative analysis that includes expert opinions of the core materials and equipment that comprise LNG Carriers.

(1) Growth Trend

The growth trend of the design/planning/construction/demand(for shipping companies)/AS categories can be substituted by the LNG carrier market. In addition, the markets for primary material and equipment during the shipbuilding stage also parallel the LNG carrier market. Based on this, the growth trend of LNG carrier is almost identical to the aforementioned factors such as shipping contracts and construction and the surrounding trends.

Based on combining the forecast data and self-estimating results of the future demand side growth and analyzing them based on average performance, CGT and price, the demand in 2030 will rise 5.7~7.1% in average on a yearly basis. This is based on the average performance between years 2010~2018. Given the fact that the overall demand for vessels is rising approximately 2.9% annually, LNG carriers and their value chain market demand will grow on a rate twice or higher compared to the overall market.

(2) Demand Stability

- Demand stability of domestic companies compared to global companies

As the beginning of this chapter mentioned, the design/planning/construction areas are strong suits of domestic corporations and as a result, primary materials and equipment were primarily analyzed. The cargo tank material is composed of alloy steel and insulation material for cargo tank. Alloy steel is supplied by 80-95% of domestic steelmakers, except Invar, and insulators are supplied by 2-3 domestic companies excluding Polywood. Both Invar and Polywood are supplied by foreign companies. Invar and Polywood are both supplied by foreign suppliers.

Most of the paint materials are supplied by 2~3 domestic companies(or JVs), and from that it can be inferred that domestic companies have high demand stability.

Two to three domestic companies produce bellows, which are parts around cargo tanks. In equipment(particularly for cargo handling), most of the global companies supply cargo pumps, cryogenic valves, inert gas generators, N2 generators, and custody transfer systems. Cargo System Domestic suppliers are only excelling in producing piping measuring devices, sensors, and heat exchangers. The average share of the first supplier of major items is 59%, and the second supplier has an average of 25%, and most of the two companies occupy more than 80%. As we can see, the market concentration is very high.

In terms of demand stability response, the first supplier of major items is 90% of the world's best companies on average. Domestic producers are particularly superior at dealing with this, and it seems like foreign suppliers are regressing on certain categories of valves and heat exchangers in comparison to domestic suppliers. The reason why is that domestic companies can respond more stably to major shipbuilders than foreign companies.

For parts(machinery), the first supplier accounts for an average of 58% market dominance while the second supplier comprises an average of 26%. Similar to the situation with cargo handling equipment, a small number of suppliers occupy most of the market. Main engines, turbochargers, propellers, generator engines, electric motors, and electric devices are items with a high share of domestic companies. Main engines, turbochargers are produced after being provided licenses by WINGD, MAN, and ABB. Major devices have a high market share of global companies such as Alfa Laval. However, the market share of domestic companies is significant, and it seems that the high market share of global companies is mainly at the request of shipowners. In terms of response rate, the first supplier is the world’s leading, and domestic corporations are similar to global corporations.

For parts(electrical and electronic equipment), the first supplier is responsible for producing 69% on average while the second supplier is responsible for the 22%. IAS, navigation systems, communication systems, and control systems are led by global companies. Domestic companies have a significant market share in some communication devices, light systems, cables, UPS, switch boards, and transformers. In terms of level of response, the first supplier, whether global or domestic, was leading globally.

Most parts(equipment) except GRP/GRE pipes are supplied by domestic companies, with the first supplier providing an average of 63%, and the second supplier providing 26%. Given that most are supplied by domestic corporations, the response rate is best on a global level.

(3) Supply Competitiveness

① Ratio of total sales of domestic companies to global companies

The ratio of total sales of domestic companies to global companies ranged from 199% to less than 1% in the value chain, excluding materials(designs and fitting) and parts(cargo storage). Material and cargo hold, in comparison with global corporations, is over 100%, and R&D/design/build material(designs and fitting) were also recorded to be 88~89%. In a comparison that examined the total sales of top 30% of global corporations and top 30% of domestic corporations, domestically produced parts(for cargo hold) are superior to global companies, and R&D/design/build material(designs and fitting) appear to be on a high level.

First and foremost, R&D/design/build have high competition because Korea’s large-scale shipyards have the amenities to compete with global corporations. Materials (cargo holds) include large domestic corporations that supply materials such as POSCO. On the other hand, in general insulation materials, because global corporations are not large scaled, domestic corporations have a superior level of competition. Because the market and skill level for material(fittings), equipment(cargo hold), and part (fittings) are not too complex, domestic corporations have an overall better competitiveness compared to global corporations. Especially for materials(fittings and painting) and parts(cargo hold), domestic conglomerates dominate the markets whereas mid-level corporations comprise the global corporations. As a result, the ratio was too high and therefore excluded from Figure 7. On the other hand, the domestic companies have low competition in machinery and electrical and electronic equipment. Since a large number of large-scale global companies such as ABB and Siem are included in the global companies of machinery and electrical and electronic equipment, a small number of large-scale companies sway the direction of the overall analysis.

In the case of shipping companies, a part of the demand stage, sale amount in Korea were very small compared to those of global companies. This is because numerous large-scale global energy companies such as Chevron and Total were included in the discussion. In addition, in the A/S stage, domestic repair shipbuilders are fewer in number and smaller in scale compared to foreign repair shipbuilders from Singapore, China, and other countries. As a result, the quality of this category is overwhelmingly inadequate comparatively.

② Ratio of domestic companies' tangible and intangible assets and total assets to global companies

The ratio of tangible assets of domestic companies to global companies ranged from 179% to at least 7.9% in each step of the value chain, excluding materials (decoration, paint) and parts cargo storage). In the cases of Materials(decoration, paint) and parts(cargo storage), domestic corporations are larger scale than global corporations. For stages in R&D/design/build, tangible assets declined in respect to global corporations and appear to recover. This is a direct response of primary domestic shipbuilding corporations selling their assets in order to restructure their finances and assets. In terms of parts(fittings) and materials(cargo storage), domestic companies appear to be superior to global companies. This is because for materials(cargo storage), global iron companies such as Posco contributed significantly to the average quality, global companies’ property, plant, and equipment are going up in terms of pump and reliquefication system even though the property, plant, and equipment of parts(cargo handling device) are decreasing steadily. Meanwhile, as major companies within the Hyundai Heavy Industries Group were incorporated as holding companies, the proportion of domestic parts (machinery) and tangible assets has rapidly increased since 2017. The proportion of tangible assets of the top 30% of global companies and the top 30% of domestic companies also does not show much difference from the average of all companies. This is because the top 30% of major sectors with a large number of companies are made up of mega-sized companies.

In terms of global corporations, domestic corporations have a particularly high share of intangible assets in material(fittings and paint) and parts(cargo storage) because of the number of corporations in the market. In terms of R&D/design/build and materials(cargo storage), domestic companies have an advantage over global companies. In other areas, demand(shipping companies) with low competitiveness is relatively higher than that of global companies. This is because Hyundai Motor Group is a part of domestic companies that produce LNG Carriers, which reflects the goodwill and R&D of shipping companies. In the case of parts(cargo handling equipment), parts(machinery equipment), and parts(electrical and electronic equipment), the proportion of intangible assets of domestic corporations is very low compared to global corporations.

When looking at the proportion of total assets of domestic companies compared to global companies, material (cargo hold), parts(fittings), R&D/design/build corporations have global competitiveness in terms of intangible assets and maintain a decent amount of competitiveness. It can also be inferred that even on the top 30% as a criterion, there is not a significant difference.

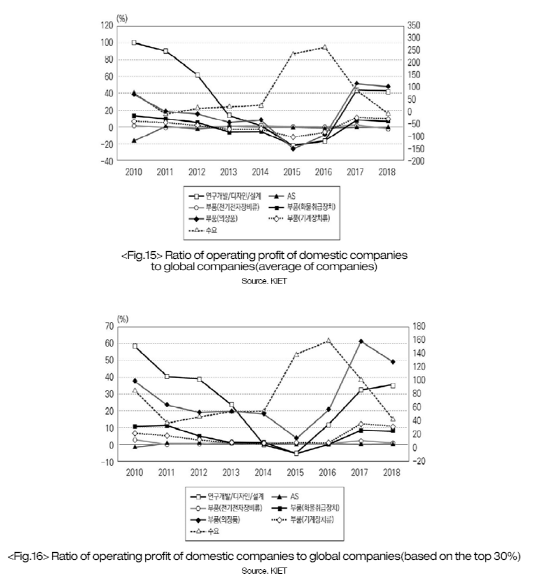

③ Ratio of operating profit and operating margin of domestic companies to global companies

In relation to global companies, the operating profit of domestic companies are significantly high in material(cargo hold) and material(fittings), parts(cargo hold), just like other categories. This is because a small number of large-scale domestic corporations and mid-sized global corporations were in comparison. Other than that, R&D/design/build are related to the profitability of domestic shipbuilding companies. Between 2013~2016, when the domestic shipbuilding profitability was significantly lowered, it compared significantly low compared to the global profit level. However, after 2017, it recovered to the similar level compared to global corporations. Demand(shipping companies) recorded operating profits at the level of global companies in 2015 and 2016, yet significantly worsened again. This is due to the fall of oil prices that negatively affected the performance of a primary global energy corporation that is also a major shipping company. For other categories, it can be observed that while the overall direction is highly similar to shipbuilding, the overall importance is relatively low. It appears that domestic companies are relatively small compared to global companies and thus have low profitability; this mirrors the analysis of the top 30% companies. However, parts(fittings) are higher than the average of global corporations. While the top-domestic corporations for parts(fittings) are not comparably earning as much as global corporations, it is only 50~60% scale, which is relatively benign.

<Table 3> shows the operating margins of global and domestic companies in the major value chain sectors. In design/design, we can see the crisis and recovery of domestic shipbuilders.

Global companies are consistently producing around 3~6% productivity and return. Many Korean shipbuilders are included in parts(mechanical devices) as well, and they are mirror the changes in shipbuilders' performance. On the other hand, the presence of mega-companies on the global level record 9~10% operating margin, which is stable and stagnant. The same case is present in parts(electronic and electrical). Domestic companies recorded low operating margins of around -1~3%, but global companies' operating margins were high and stable at 9-11%. For demand(shipping company), the operating margin of domestic companies continued to decline from 9% to 3%, but global companies once fell to 3% and recovered to 8.4%, which is contradictory. The reason behind this is because energy companies that produce LNG carriers were factored into the analysis. While global energy companies were affected by the decline and recovery of oil prices, Korea's energy companies are independently affected by domestic factors rather than oil prices.

※ Will continue next month.